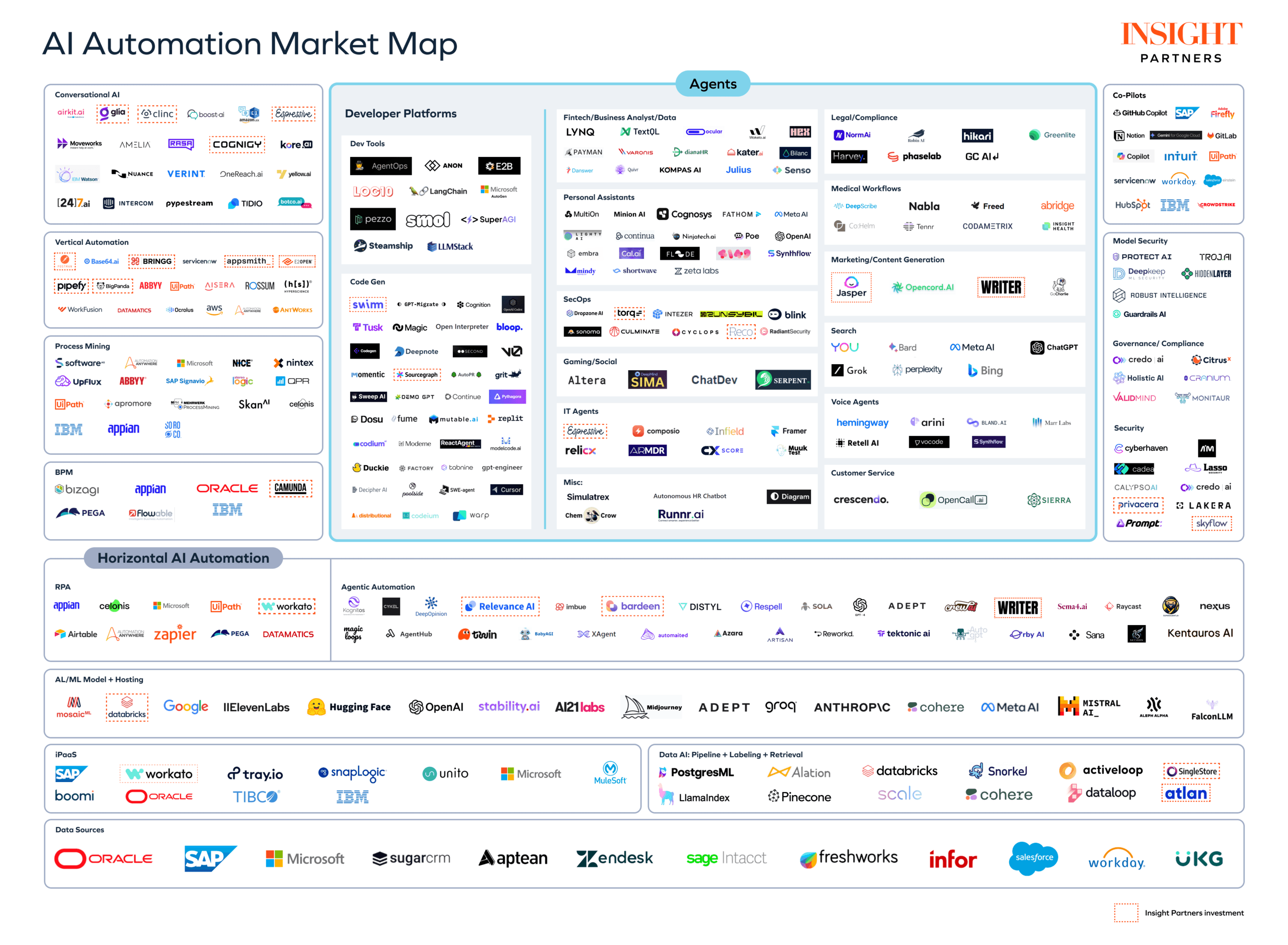

Insight Partners has invested over $4B in artificial intelligence and data ScaleUps.

We’ve been tracking 37,240 AI/ML startups and ScaleUps since 2014.

Building a valid artificial intelligence (AI) model is an iterative process. Investors need to be willing to commit to the long-term time horizons necessary for the engineering and data science powering AI to deliver value. We believe an important factor of the AI and machine learning (ML) market is how this tech applies not only as a vertical business model but also as a horizontally-integrated aspect of many other technology sectors. The wide-ranging use cases for AI are driving opportunities in tech today, including generative AI for writing and design, AI-assisted diagnostic health technologies, and AI-powered efficiency improvements across industries.

We believe that AI is integral to B2C and B2B software, and Insight is searching for economic moats, whether in ScaleUps building large foundational models, fine-tuning the models for specific use cases, or even in non-AI software where models integrate with real-world systems. We see opportunities for new MLOps tools and skills, as well as foundational AI models for specific domains.

With deep market expertise, experienced business operators in Insight Onsite, and a dedicated industry-wide conference, ScaleUp:AI, we are positioned to help AI/ML & Data companies win in the market.

With our deep industry experience, we’ve selected 110+ high-quality AI/ML & Data companies that we believe are transforming the industry.

Insight Onsite

We are software operators. We specialize in helping Founders and leaders navigate the ScaleUp chasm.

Onsite’s Sales & Customer Success Center of Excellence team has walked in your shoes. We’ve carried a bag and owned the number. Our sales leaders help ScaleUps develop GTM strategy, refine sales processes, and troubleshoot execution challenges. Our customer success leaders know how to deliver upsell, cross-sell, and high retention.

Types of Advisory Engagements

- Sales Capacity Planning and Territory Design: Advisory and tools to determine the number of sellers and sales support to achieve your growth goals.

- Forecasting and Pipeline Management: Best practices that run the gamut from discovery to pipeline review and forecast management; our operators ensure you’re well positioned to meet quarterly and annual goals.

- Process Optimization: Agile strategies to optimize Go-to-Market processes including Lead-to-Quote and Quote-to-Cash. Through our expert advice, ScaleUps remove waste and bottlenecks in these processes to improve time to value by as much, or more, than 25%.

- Channel Development and Management: Strategic advisory to build alternative channels to market via distributors, system integrators, and resellers.

- Churn Mitigation and Customer Expansion: Strategies and tactics to address customer churn and build a sustainable expansion process.

Onsite’s Marketing Center of Excellence supports ScaleUp growth through right-sized marketing strategies and tactics. We can help build a memorable brand, scale your marketing team and strategy, and create a demand generation plan that delivers pipeline.

Types of Advisory Engagements

- Brand Transformation: Frameworks and advisory to activate an effective brand that drives sustained business growth.

- Analyst Relations: Strategic advisory to build analyst relations foundations or increase the impact of an existing AR strategy.

- ABX Advisory: Know-how for account-based experience (ABX) strategies that drive valuable personalized experience to key personas at priority accounts.

- B2C Advisory: Tactical and foundational offerings that drive sustainable growth for our consumer-focused ScaleUps.

- Budgeting and Planning: Expense guidance so that marketing is appropriately resourced to support business goals.

Onsite’s Talent Center of Excellence team knows that people are a critical driver of company growth. As revenue grows, so does team size, and recruiting becomes essential to company success. We help companies source, attract, and retain top talent — from individual contributors to the C-suite — as well as establish robust human capital practices to ensure founders can scale their organization and culture over time.

Types of Advisory Engagements

- Executive Talent Pipeline: We introduce the best executives to help you scale.

- Individual Contributor Technologist Pipeline: Our programs help build the best tech teams to achieve your product vision.

- Executive Recruiting Support: Systematic processes and C-level interviews to help you make the right talent decisions.

- Untapped Talent Pipeline: Best practice advice on how to foster diverse and inclusive teams as core to a winning culture.

- HR and People Advisory: Strategic advisory for people engagement and retention.

- Organization Design: Guidance on how to build team structures that are efficient and scale over time.

Onsite’s Product & Technology Center of Excellence experts work with software leaders to plan and execute their product and technology roadmap. With operating experience across sectors and company sizes, our know-how supports ScaleUps as they build products that can win in the market while scaling successfully through multiple stages of growth.

Types of Advisory Engagements

- Product Strategy: Product strategy and roadmaps that align with your ScaleUp’s objectives to win.

- Technology and Architecture: Engineering excellence across software engineering practices, including cloud architecture design, DevOps, and security.

- Pricing and Packaging: Strategies to deploy a significant growth lever through price execution, freemium, and packaging strategies.

- R&D Operations: Advisory to measure, analyze, report, and execute with the most effective processes, tools, and systems.

Selling to enterprise buyers can be challenging without executive sponsorship and access to decision-makers. Insight Partners for Enterprise bridges this gap through our network and relationships with over 5,000 Global 2000 IT executives. We make introductions so that our companies get the opportunity to drive real revenue.

Types of Advisory Engagements

- Enterprise Introductions: Benefit from qualified enterprise buyer introductions.

- Brand Exposure: Receive brand exposure through Insight’s events and partner-level relationships

- Executive Feedback: Obtain messaging feedback from C-suite leaders.

- Valuable Relationships: Engage with potential advisory and board members.

Insight Partners’ Diligence and Growth Strategy team works with portfolio companies from initial due diligence, through the moment of investment and alongside each ScaleUp’s growth journey. We create engagement plans to support your growth objectives using Insight’s broad network, our market knowledge, and our software-specific Centers of Excellence. Our goal is to anticipate the advice you need, at the right time, and to realize maximum impact.

Before joining Insight, we worked at brand-name consulting firms. Now we deploy our expertise at high-growth software companies by advising CEOs, Founders and leadership teams on their most important challenges. We’re on site, alongside, and with you every step of the way.

Types of Advisory Engagements

- Board meeting and fund-raising materials

- FP&A, including efficiency benchmarks and business operations

- Budgeting and strategic planning

- M&A target identification, due diligence, and post-merger integration

- Exit planning and data-room execution

Onsite’s diligence & growth strategy team and Center of Excellence operators have tailored blueprints, playbooks, workshops, programs and content to help you scale up, so that you can take off.

M&A is a great lever to scale rapidly. Every year, Insight supports dozens of add-on acquisitions across our portfolio. M&A can be an effective strategy to grow products and services, expand geographical footprint, acquihire for talent, and increase market share. Insight’s years of experience across hundreds of M&A transactions ensures we’re a strong partner when companies start M&A for the first time.

Types of Advisory Engagements

There are six core components of any successful M&A process:

- Developing a clear M&A strategy and rationale

- Mapping the market to find the right opportunity

- Conducting valuation analysis and diligence

- Negotiating and executing the deal

- Financing (via debt and equity)

- Consolidating and post-merger integration

Our M&A experts support every stage of the process to ensure a successful outcome. Scale Up, Take Off with our capital and expertise.

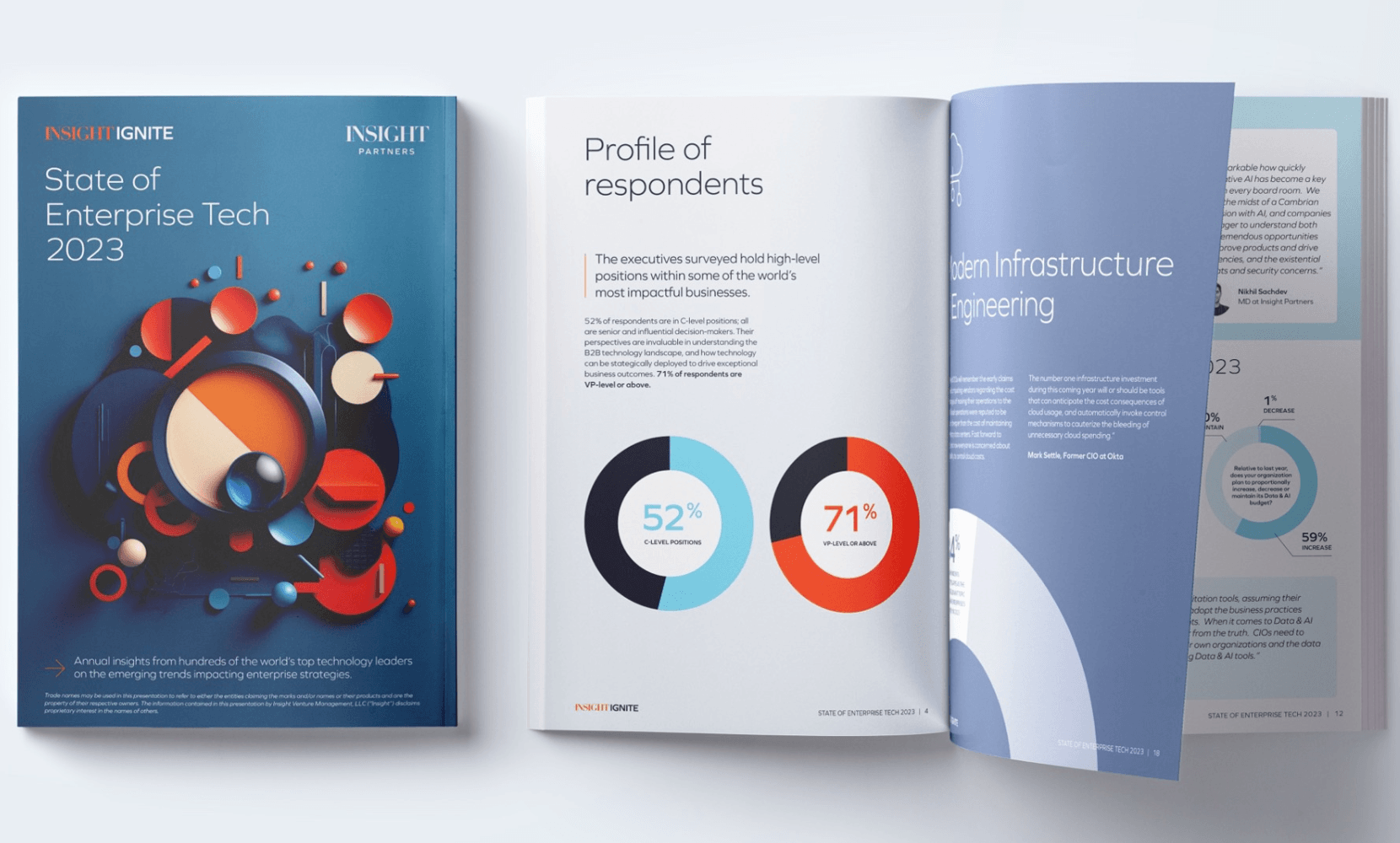

Featured Content

Next Sector: Consumer

THIS IS NOT AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES. The information and opinions contained in this presentation are for background purposes only, is subject to change without notice, and do not purport to be full or complete and Insight has no obligation to update it. No reliance may be placed for any purpose on the information or opinions contained in this presentation or their accuracy or completeness. Certain statements made throughout this Presentation that are not historical facts may contain forward-looking statements regarding the intentions, expectations, objectives and targets of the relevant funds. Any such forward-looking statements are based on assumptions that Insight believes to be reasonable, but are subject to a wide range of risks and uncertainties and, therefore, there can be no assurance that actual results may not differ from those expressed or implied by such forward-looking statements. There is no guarantee that future Insight funds will have access to similar investment opportunities or that such investment opportunities will be profitable or as profitable. The above statements reflect Insight’s opinions about the current state and future of this sector, which are based on its research and experience and that it believes to be reasonable. Investment in securities involves risk and value of investments and income derived from such investments may fluctuate. Past performance is not an indication or guarantee of future results. Trends are not guaranteed to continue. The Recent Investments reflect Insight’s four most recent investments in the sector.

Insight Partners has invested over $900M globally seeking to build enduring brands customers know and love.

Since 2014, we’ve been following the journey of more than 21,250 Consumer Internet brands.

With our deep industry experience, we’ve selected 70+ high-quality Consumer companies that we believe are transforming the industry.

Insight Onsite

We are software operators. We specialize in helping Founders and leaders navigate the ScaleUp chasm.

Onsite’s Sales & Customer Success Center of Excellence team has walked in your shoes. We’ve carried a bag and owned the number. Our sales leaders help ScaleUps develop GTM strategy, refine sales processes, and troubleshoot execution challenges. Our customer success leaders know how to deliver upsell, cross-sell, and high retention.

Types of Advisory Engagements

- Sales Capacity Planning and Territory Design: Advisory and tools to determine the number of sellers and sales support to achieve your growth goals.

- Forecasting and Pipeline Management: Best practices that run the gamut from discovery to pipeline review and forecast management; our operators ensure you’re well positioned to meet quarterly and annual goals.

- Process Optimization: Agile strategies to optimize Go-to-Market processes including Lead-to-Quote and Quote-to-Cash. Through our expert advice, ScaleUps remove waste and bottlenecks in these processes to improve time to value by as much, or more, than 25%.

- Channel Development and Management: Strategic advisory to build alternative channels to market via distributors, system integrators, and resellers.

- Churn Mitigation and Customer Expansion: Strategies and tactics to address customer churn and build a sustainable expansion process.

Onsite’s Marketing Center of Excellence supports ScaleUp growth through right-sized marketing strategies and tactics. We can help build a memorable brand, scale your marketing team and strategy, and create a demand generation plan that delivers pipeline.

Types of Advisory Engagements

- Brand Transformation: Frameworks and advisory to activate an effective brand that drives sustained business growth.

- Analyst Relations: Strategic advisory to build analyst relations foundations or increase the impact of an existing AR strategy.

- ABX Advisory: Know-how for account-based experience (ABX) strategies that drive valuable personalized experience to key personas at priority accounts.

- B2C Advisory: Tactical and foundational offerings that drive sustainable growth for our consumer-focused ScaleUps.

- Budgeting and Planning: Expense guidance so that marketing is appropriately resourced to support business goals.

Onsite’s Talent Center of Excellence team knows that people are a critical driver of company growth. As revenue grows, so does team size, and recruiting becomes essential to company success. We help companies source, attract, and retain top talent — from individual contributors to the C-suite — as well as establish robust human capital practices to ensure founders can scale their organization and culture over time.

Types of Advisory Engagements

- Executive Talent Pipeline: We introduce the best executives to help you scale.

- Individual Contributor Technologist Pipeline: Our programs help build the best tech teams to achieve your product vision.

- Executive Recruiting Support: Systematic processes and C-level interviews to help you make the right talent decisions.

- Untapped Talent Pipeline: Best practice advice on how to foster diverse and inclusive teams as core to a winning culture.

- HR and People Advisory: Strategic advisory for people engagement and retention.

- Organization Design: Guidance on how to build team structures that are efficient and scale over time.

Onsite’s Product & Technology Center of Excellence experts work with software leaders to plan and execute their product and technology roadmap. With operating experience across sectors and company sizes, our know-how supports ScaleUps as they build products that can win in the market while scaling successfully through multiple stages of growth.

Types of Advisory Engagements

- Product Strategy: Product strategy and roadmaps that align with your ScaleUp’s objectives to win.

- Technology and Architecture: Engineering excellence across software engineering practices, including cloud architecture design, DevOps, and security.

- Pricing and Packaging: Strategies to deploy a significant growth lever through price execution, freemium, and packaging strategies.

- R&D Operations: Advisory to measure, analyze, report, and execute with the most effective processes, tools, and systems.

Selling to enterprise buyers can be challenging without executive sponsorship and access to decision-makers. Insight Partners for Enterprise bridges this gap through our network and relationships with over 5,000 Global 2000 IT executives. We make introductions so that our companies get the opportunity to drive real revenue.

Types of Advisory Engagements

- Enterprise Introductions: Benefit from qualified enterprise buyer introductions.

- Brand Exposure: Receive brand exposure through Insight’s events and partner-level relationships

- Executive Feedback: Obtain messaging feedback from C-suite leaders.

- Valuable Relationships: Engage with potential advisory and board members.

Insight Partners’ Diligence and Growth Strategy team works with portfolio companies from initial due diligence, through the moment of investment and alongside each ScaleUp’s growth journey. We create engagement plans to support your growth objectives using Insight’s broad network, our market knowledge, and our software-specific Centers of Excellence. Our goal is to anticipate the advice you need, at the right time, and to realize maximum impact.

Before joining Insight, we worked at brand-name consulting firms. Now we deploy our expertise at high-growth software companies by advising CEOs, Founders and leadership teams on their most important challenges. We’re on site, alongside, and with you every step of the way.

Types of Advisory Engagements

- Board meeting and fund-raising materials

- FP&A, including efficiency benchmarks and business operations

- Budgeting and strategic planning

- M&A target identification, due diligence, and post-merger integration

- Exit planning and data-room execution

Onsite’s diligence & growth strategy team and Center of Excellence operators have tailored blueprints, playbooks, workshops, programs and content to help you scale up, so that you can take off.

M&A is a great lever to scale rapidly. Every year, Insight supports dozens of add-on acquisitions across our portfolio. M&A can be an effective strategy to grow products and services, expand geographical footprint, acquihire for talent, and increase market share. Insight’s years of experience across hundreds of M&A transactions ensures we’re a strong partner when companies start M&A for the first time.

Types of Advisory Engagements

There are six core components of any successful M&A process:

- Developing a clear M&A strategy and rationale

- Mapping the market to find the right opportunity

- Conducting valuation analysis and diligence

- Negotiating and executing the deal

- Financing (via debt and equity)

- Consolidating and post-merger integration

Our M&A experts support every stage of the process to ensure a successful outcome. Scale Up, Take Off with our capital and expertise.

Featured Content

Next Sector: Cybersecurity

THIS IS NOT AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES. The information and opinions contained in this presentation are for background purposes only, is subject to change without notice, and do not purport to be full or complete and Insight has no obligation to update it. No reliance may be placed for any purpose on the information or opinions contained in this presentation or their accuracy or completeness. Certain statements made throughout this Presentation that are not historical facts may contain forward-looking statements regarding the intentions, expectations, objectives and targets of the relevant funds. Any such forward-looking statements are based on assumptions that Insight believes to be reasonable, but are subject to a wide range of risks and uncertainties and, therefore, there can be no assurance that actual results may not differ from those expressed or implied by such forward-looking statements. There is no guarantee that future Insight funds will have access to similar investment opportunities or that such investment opportunities will be profitable or as profitable. The above statements reflect Insight’s opinions about the current state and future of this sector, which are based on its research and experience and that it believes to be reasonable. Investment in securities involves risk and value of investments and income derived from such investments may fluctuate. Past performance is not an indication or guarantee of future results. Trends are not guaranteed to continue. The Recent Investments reflect Insight’s four most recent investments in the sector.

Our deep commitment to the value of the Cybersecurity sector is reflected in our $5B+ investments in these ScaleUps.

We’ve been tracking 10,063 Cybersecurity companies since 2014.

Cybersecurity is intertwined with each critical system, all sensitive business information, and our private lives. With cyber crime on the rise – targeting personally identifiable information, as well as critical country and business infrastructure – Insight is committed to investing in Cybersecurity ScaleUps that seek to combat threats, and enable business and society to manage their risk from bad actors.

Our deep experience spans many aspects of security including application, business continuity, cloud, disaster recovery, endpoint, data, IoT, mobile, network and storage security, along with user education and security training. AI and demand-side neural networks are frontier cyber technologies that seek to thwart threats.

With our deep industry experience, we’ve selected 90+ high-quality Cybersecurity companies that we believe are transforming the industry.

Insight Onsite

We are software operators. We specialize in helping Founders and leaders navigate the ScaleUp chasm.

Onsite’s Sales & Customer Success Center of Excellence team has walked in your shoes. We’ve carried a bag and owned the number. Our sales leaders help ScaleUps develop GTM strategy, refine sales processes, and troubleshoot execution challenges. Our customer success leaders know how to deliver upsell, cross-sell, and high retention.

Types of Advisory Engagements

- Sales Capacity Planning and Territory Design: Advisory and tools to determine the number of sellers and sales support to achieve your growth goals.

- Forecasting and Pipeline Management: Best practices that run the gamut from discovery to pipeline review and forecast management; our operators ensure you’re well positioned to meet quarterly and annual goals.

- Process Optimization: Agile strategies to optimize Go-to-Market processes including Lead-to-Quote and Quote-to-Cash. Through our expert advice, ScaleUps remove waste and bottlenecks in these processes to improve time to value by as much, or more, than 25%.

- Channel Development and Management: Strategic advisory to build alternative channels to market via distributors, system integrators, and resellers.

- Churn Mitigation and Customer Expansion: Strategies and tactics to address customer churn and build a sustainable expansion process.

Onsite’s Marketing Center of Excellence supports ScaleUp growth through right-sized marketing strategies and tactics. We can help build a memorable brand, scale your marketing team and strategy, and create a demand generation plan that delivers pipeline.

Types of Advisory Engagements

- Brand Transformation: Frameworks and advisory to activate an effective brand that drives sustained business growth.

- Analyst Relations: Strategic advisory to build analyst relations foundations or increase the impact of an existing AR strategy.

- ABX Advisory: Know-how for account-based experience (ABX) strategies that drive valuable personalized experience to key personas at priority accounts.

- B2C Advisory: Tactical and foundational offerings that drive sustainable growth for our consumer-focused ScaleUps.

- Budgeting and Planning: Expense guidance so that marketing is appropriately resourced to support business goals.

Onsite’s Talent Center of Excellence team knows that people are a critical driver of company growth. As revenue grows, so does team size, and recruiting becomes essential to company success. We help companies source, attract, and retain top talent — from individual contributors to the C-suite — as well as establish robust human capital practices to ensure founders can scale their organization and culture over time.

Types of Advisory Engagements

- Executive Talent Pipeline: We introduce the best executives to help you scale.

- Individual Contributor Technologist Pipeline: Our programs help build the best tech teams to achieve your product vision.

- Executive Recruiting Support: Systematic processes and C-level interviews to help you make the right talent decisions.

- Untapped Talent Pipeline: Best practice advice on how to foster diverse and inclusive teams as core to a winning culture.

- HR and People Advisory: Strategic advisory for people engagement and retention.

- Organization Design: Guidance on how to build team structures that are efficient and scale over time.

Onsite’s Product & Technology Center of Excellence experts work with software leaders to plan and execute their product and technology roadmap. With operating experience across sectors and company sizes, our know-how supports ScaleUps as they build products that can win in the market while scaling successfully through multiple stages of growth.

Types of Advisory Engagements

- Product Strategy: Product strategy and roadmaps that align with your ScaleUp’s objectives to win.

- Technology and Architecture: Engineering excellence across software engineering practices, including cloud architecture design, DevOps, and security.

- Pricing and Packaging: Strategies to deploy a significant growth lever through price execution, freemium, and packaging strategies.

- R&D Operations: Advisory to measure, analyze, report, and execute with the most effective processes, tools, and systems.

Selling to enterprise buyers can be challenging without executive sponsorship and access to decision-makers. Insight Partners for Enterprise bridges this gap through our network and relationships with over 5,000 Global 2000 IT executives. We make introductions so that our companies get the opportunity to drive real revenue.

Types of Advisory Engagements

- Enterprise Introductions: Benefit from qualified enterprise buyer introductions.

- Brand Exposure: Receive brand exposure through Insight’s events and partner-level relationships

- Executive Feedback: Obtain messaging feedback from C-suite leaders.

- Valuable Relationships: Engage with potential advisory and board members.

Insight Partners’ Diligence and Growth Strategy team works with portfolio companies from initial due diligence, through the moment of investment and alongside each ScaleUp’s growth journey. We create engagement plans to support your growth objectives using Insight’s broad network, our market knowledge, and our software-specific Centers of Excellence. Our goal is to anticipate the advice you need, at the right time, and to realize maximum impact.

Before joining Insight, we worked at brand-name consulting firms. Now we deploy our expertise at high-growth software companies by advising CEOs, Founders and leadership teams on their most important challenges. We’re on site, alongside, and with you every step of the way.

Types of Advisory Engagements

- Board meeting and fund-raising materials

- FP&A, including efficiency benchmarks and business operations

- Budgeting and strategic planning

- M&A target identification, due diligence, and post-merger integration

- Exit planning and data-room execution

Onsite’s diligence & growth strategy team and Center of Excellence operators have tailored blueprints, playbooks, workshops, programs and content to help you scale up, so that you can take off.

M&A is a great lever to scale rapidly. Every year, Insight supports dozens of add-on acquisitions across our portfolio. M&A can be an effective strategy to grow products and services, expand geographical footprint, acquihire for talent, and increase market share. Insight’s years of experience across hundreds of M&A transactions ensures we’re a strong partner when companies start M&A for the first time.

Types of Advisory Engagements

There are six core components of any successful M&A process:

- Developing a clear M&A strategy and rationale

- Mapping the market to find the right opportunity

- Conducting valuation analysis and diligence

- Negotiating and executing the deal

- Financing (via debt and equity)

- Consolidating and post-merger integration

Our M&A experts support every stage of the process to ensure a successful outcome. Scale Up, Take Off with our capital and expertise.

Featured Content

Next Sector: DevOps

THIS IS NOT AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES. The information and opinions contained in this presentation are for background purposes only, is subject to change without notice, and do not purport to be full or complete and Insight has no obligation to update it. No reliance may be placed for any purpose on the information or opinions contained in this presentation or their accuracy or completeness. Certain statements made throughout this Presentation that are not historical facts may contain forward-looking statements regarding the intentions, expectations, objectives and targets of the relevant funds. Any such forward-looking statements are based on assumptions that Insight believes to be reasonable, but are subject to a wide range of risks and uncertainties and, therefore, there can be no assurance that actual results may not differ from those expressed or implied by such forward-looking statements. There is no guarantee that future Insight funds will have access to similar investment opportunities or that such investment opportunities will be profitable or as profitable. The above statements reflect Insight’s opinions about the current state and future of this sector, which are based on its research and experience and that it believes to be reasonable. Investment in securities involves risk and value of investments and income derived from such investments may fluctuate. Past performance is not an indication or guarantee of future results. Trends are not guaranteed to continue. The Recent Investments reflect Insight’s four most recent investments in the sector.

Insight Partners has invested over $3B in DevOps seeking to realize the integration potential of developers, IT operations, quality testing and security.

We’ve tracked the evolution of 3,792 DevOps startups and ScaleUps since 2014.

THENEWSTACK, which serves as a source of DevOps best practices, notes that highly evolved firms are making extensive DevOps automation a focus as software development lifecycles become increasingly automated and cloud-based. According to THENEWSTACK, only a fraction of the DevOps model’s capacity is being used today, with DevOps’ upside yet to be fully implemented.

Insight invests in software ScaleUps seeking to realize the potential of DevOps via:

- Tool kits and automation for DevOps teams

- Capabilities to move from traditional infrastructure to microservices architecture

- Processes that adapt firm culture to enhance DevOps teams

We believe that organizations that adopt innovative technologies and grow with new DevOps trends will continue to have an edge – and we’re investing to support this edge.

With our deep industry experience, we’ve selected 60+ high-quality DevOps companies that we believe are transforming the industry.

Insight Onsite

We are software operators. We specialize in helping Founders and leaders navigate the ScaleUp chasm.

Onsite’s Sales & Customer Success Center of Excellence team has walked in your shoes. We’ve carried a bag and owned the number. Our sales leaders help ScaleUps develop GTM strategy, refine sales processes, and troubleshoot execution challenges. Our customer success leaders know how to deliver upsell, cross-sell, and high retention.

Types of Advisory Engagements

- Sales Capacity Planning and Territory Design: Advisory and tools to determine the number of sellers and sales support to achieve your growth goals.

- Forecasting and Pipeline Management: Best practices that run the gamut from discovery to pipeline review and forecast management; our operators ensure you’re well positioned to meet quarterly and annual goals.

- Process Optimization: Agile strategies to optimize Go-to-Market processes including Lead-to-Quote and Quote-to-Cash. Through our expert advice, ScaleUps remove waste and bottlenecks in these processes to improve time to value by as much, or more, than 25%.

- Channel Development and Management: Strategic advisory to build alternative channels to market via distributors, system integrators, and resellers.

- Churn Mitigation and Customer Expansion: Strategies and tactics to address customer churn and build a sustainable expansion process.

Onsite’s Marketing Center of Excellence supports ScaleUp growth through right-sized marketing strategies and tactics. We can help build a memorable brand, scale your marketing team and strategy, and create a demand generation plan that delivers pipeline.

Types of Advisory Engagements

- Brand Transformation: Frameworks and advisory to activate an effective brand that drives sustained business growth.

- Analyst Relations: Strategic advisory to build analyst relations foundations or increase the impact of an existing AR strategy.

- ABX Advisory: Know-how for account-based experience (ABX) strategies that drive valuable personalized experience to key personas at priority accounts.

- B2C Advisory: Tactical and foundational offerings that drive sustainable growth for our consumer-focused ScaleUps.

- Budgeting and Planning: Expense guidance so that marketing is appropriately resourced to support business goals.

Onsite’s Talent Center of Excellence team knows that people are a critical driver of company growth. As revenue grows, so does team size, and recruiting becomes essential to company success. We help companies source, attract, and retain top talent — from individual contributors to the C-suite — as well as establish robust human capital practices to ensure founders can scale their organization and culture over time.

Types of Advisory Engagements

- Executive Talent Pipeline: We introduce the best executives to help you scale.

- Individual Contributor Technologist Pipeline: Our programs help build the best tech teams to achieve your product vision.

- Executive Recruiting Support: Systematic processes and C-level interviews to help you make the right talent decisions.

- Untapped Talent Pipeline: Best practice advice on how to foster diverse and inclusive teams as core to a winning culture.

- HR and People Advisory: Strategic advisory for people engagement and retention.

- Organization Design: Guidance on how to build team structures that are efficient and scale over time.

Onsite’s Product & Technology Center of Excellence experts work with software leaders to plan and execute their product and technology roadmap. With operating experience across sectors and company sizes, our know-how supports ScaleUps as they build products that can win in the market while scaling successfully through multiple stages of growth.

Types of Advisory Engagements

- Product Strategy: Product strategy and roadmaps that align with your ScaleUp’s objectives to win.

- Technology and Architecture: Engineering excellence across software engineering practices, including cloud architecture design, DevOps, and security.

- Pricing and Packaging: Strategies to deploy a significant growth lever through price execution, freemium, and packaging strategies.

- R&D Operations: Advisory to measure, analyze, report, and execute with the most effective processes, tools, and systems.

Selling to enterprise buyers can be challenging without executive sponsorship and access to decision-makers. Insight Partners for Enterprise bridges this gap through our network and relationships with over 5,000 Global 2000 IT executives. We make introductions so that our companies get the opportunity to drive real revenue.

Types of Advisory Engagements

- Enterprise Introductions: Benefit from qualified enterprise buyer introductions.

- Brand Exposure: Receive brand exposure through Insight’s events and partner-level relationships

- Executive Feedback: Obtain messaging feedback from C-suite leaders.

- Valuable Relationships: Engage with potential advisory and board members.

Insight Partners’ Diligence and Growth Strategy team works with portfolio companies from initial due diligence, through the moment of investment and alongside each ScaleUp’s growth journey. We create engagement plans to support your growth objectives using Insight’s broad network, our market knowledge, and our software-specific Centers of Excellence. Our goal is to anticipate the advice you need, at the right time, and to realize maximum impact.

Before joining Insight, we worked at brand-name consulting firms. Now we deploy our expertise at high-growth software companies by advising CEOs, Founders and leadership teams on their most important challenges. We’re on site, alongside, and with you every step of the way.

Types of Advisory Engagements

- Board meeting and fund-raising materials

- FP&A, including efficiency benchmarks and business operations

- Budgeting and strategic planning

- M&A target identification, due diligence, and post-merger integration

- Exit planning and data-room execution

Onsite’s diligence & growth strategy team and Center of Excellence operators have tailored blueprints, playbooks, workshops, programs and content to help you scale up, so that you can take off.

M&A is a great lever to scale rapidly. Every year, Insight supports dozens of add-on acquisitions across our portfolio. M&A can be an effective strategy to grow products and services, expand geographical footprint, acquihire for talent, and increase market share. Insight’s years of experience across hundreds of M&A transactions ensures we’re a strong partner when companies start M&A for the first time.

Types of Advisory Engagements

There are six core components of any successful M&A process:

- Developing a clear M&A strategy and rationale

- Mapping the market to find the right opportunity

- Conducting valuation analysis and diligence

- Negotiating and executing the deal

- Financing (via debt and equity)

- Consolidating and post-merger integration

Our M&A experts support every stage of the process to ensure a successful outcome. Scale Up, Take Off with our capital and expertise.

Featured Content

Next Sector: eCommerce

THIS IS NOT AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES. The information and opinions contained in this presentation are for background purposes only, is subject to change without notice, and do not purport to be full or complete and Insight has no obligation to update it. No reliance may be placed for any purpose on the information or opinions contained in this presentation or their accuracy or completeness. Certain statements made throughout this Presentation that are not historical facts may contain forward-looking statements regarding the intentions, expectations, objectives and targets of the relevant funds. Any such forward-looking statements are based on assumptions that Insight believes to be reasonable, but are subject to a wide range of risks and uncertainties and, therefore, there can be no assurance that actual results may not differ from those expressed or implied by such forward-looking statements. There is no guarantee that future Insight funds will have access to similar investment opportunities or that such investment opportunities will be profitable or as profitable. The above statements reflect Insight’s opinions about the current state and future of this sector, which are based on its research and experience and that it believes to be reasonable. Investment in securities involves risk and value of investments and income derived from such investments may fluctuate. Past performance is not an indication or guarantee of future results. Trends are not guaranteed to continue. The Recent Investments reflect Insight’s four most recent investments in the sector.

We’ve invested more than $4B in eCommerce platforms that we believe power online transactions.

We’ve tracked the global marketplace, with 18,040 Digital Commerce startups and ScaleUps in our sight since 2014.

Digital commerce relies on the platforms and software solutions that enable a seamless customer buying experience. This includes rich content management, dynamic pricing, no latency, responsive websites, BNPL options, same-day delivery, and superlative customer service. This, coupled with comprehensive inventory, omni-channel sales, personalization, consumer privacy, and predictive buying behavior – to name a few, demonstrates the increasing complexity of the marketplace and eCommerce landscape.

Insight’s investments are intended to bring buyers and sellers together and to facilitate seamless, personalized and secure transactions, with high satisfaction.

With our deep industry experience, we’ve selected 80+ high-quality eCommerce companies that we believe are transforming the industry.

Insight Onsite

We are software operators. We specialize in helping Founders and leaders navigate the ScaleUp chasm.

Onsite’s Sales & Customer Success Center of Excellence team has walked in your shoes. We’ve carried a bag and owned the number. Our sales leaders help ScaleUps develop GTM strategy, refine sales processes, and troubleshoot execution challenges. Our customer success leaders know how to deliver upsell, cross-sell, and high retention.

Types of Advisory Engagements

- Sales Capacity Planning and Territory Design: Advisory and tools to determine the number of sellers and sales support to achieve your growth goals.

- Forecasting and Pipeline Management: Best practices that run the gamut from discovery to pipeline review and forecast management; our operators ensure you’re well positioned to meet quarterly and annual goals.

- Process Optimization: Agile strategies to optimize Go-to-Market processes including Lead-to-Quote and Quote-to-Cash. Through our expert advice, ScaleUps remove waste and bottlenecks in these processes to improve time to value by as much, or more, than 25%.

- Channel Development and Management: Strategic advisory to build alternative channels to market via distributors, system integrators, and resellers.

- Churn Mitigation and Customer Expansion: Strategies and tactics to address customer churn and build a sustainable expansion process.

Onsite’s Marketing Center of Excellence supports ScaleUp growth through right-sized marketing strategies and tactics. We can help build a memorable brand, scale your marketing team and strategy, and create a demand generation plan that delivers pipeline.

Types of Advisory Engagements

- Brand Transformation: Frameworks and advisory to activate an effective brand that drives sustained business growth.

- Analyst Relations: Strategic advisory to build analyst relations foundations or increase the impact of an existing AR strategy.

- ABX Advisory: Know-how for account-based experience (ABX) strategies that drive valuable personalized experience to key personas at priority accounts.

- B2C Advisory: Tactical and foundational offerings that drive sustainable growth for our consumer-focused ScaleUps.

- Budgeting and Planning: Expense guidance so that marketing is appropriately resourced to support business goals.

Onsite’s Talent Center of Excellence team knows that people are a critical driver of company growth. As revenue grows, so does team size, and recruiting becomes essential to company success. We help companies source, attract, and retain top talent — from individual contributors to the C-suite — as well as establish robust human capital practices to ensure founders can scale their organization and culture over time.

Types of Advisory Engagements

- Executive Talent Pipeline: We introduce the best executives to help you scale.

- Individual Contributor Technologist Pipeline: Our programs help build the best tech teams to achieve your product vision.

- Executive Recruiting Support: Systematic processes and C-level interviews to help you make the right talent decisions.

- Untapped Talent Pipeline: Best practice advice on how to foster diverse and inclusive teams as core to a winning culture.

- HR and People Advisory: Strategic advisory for people engagement and retention.

- Organization Design: Guidance on how to build team structures that are efficient and scale over time.

Onsite’s Product & Technology Center of Excellence experts work with software leaders to plan and execute their product and technology roadmap. With operating experience across sectors and company sizes, our know-how supports ScaleUps as they build products that can win in the market while scaling successfully through multiple stages of growth.

Types of Advisory Engagements

- Product Strategy: Product strategy and roadmaps that align with your ScaleUp’s objectives to win.

- Technology and Architecture: Engineering excellence across software engineering practices, including cloud architecture design, DevOps, and security.

- Pricing and Packaging: Strategies to deploy a significant growth lever through price execution, freemium, and packaging strategies.

- R&D Operations: Advisory to measure, analyze, report, and execute with the most effective processes, tools, and systems.

Selling to enterprise buyers can be challenging without executive sponsorship and access to decision-makers. Insight Partners for Enterprise bridges this gap through our network and relationships with over 5,000 Global 2000 IT executives. We make introductions so that our companies get the opportunity to drive real revenue.

Types of Advisory Engagements

- Enterprise Introductions: Benefit from qualified enterprise buyer introductions.

- Brand Exposure: Receive brand exposure through Insight’s events and partner-level relationships

- Executive Feedback: Obtain messaging feedback from C-suite leaders.

- Valuable Relationships: Engage with potential advisory and board members.

Insight Partners’ Diligence and Growth Strategy team works with portfolio companies from initial due diligence, through the moment of investment and alongside each ScaleUp’s growth journey. We create engagement plans to support your growth objectives using Insight’s broad network, our market knowledge, and our software-specific Centers of Excellence. Our goal is to anticipate the advice you need, at the right time, and to realize maximum impact.

Before joining Insight, we worked at brand-name consulting firms. Now we deploy our expertise at high-growth software companies by advising CEOs, Founders and leadership teams on their most important challenges. We’re on site, alongside, and with you every step of the way.

Types of Advisory Engagements

- Board meeting and fund-raising materials

- FP&A, including efficiency benchmarks and business operations

- Budgeting and strategic planning

- M&A target identification, due diligence, and post-merger integration

- Exit planning and data-room execution

Onsite’s diligence & growth strategy team and Center of Excellence operators have tailored blueprints, playbooks, workshops, programs and content to help you scale up, so that you can take off.

M&A is a great lever to scale rapidly. Every year, Insight supports dozens of add-on acquisitions across our portfolio. M&A can be an effective strategy to grow products and services, expand geographical footprint, acquihire for talent, and increase market share. Insight’s years of experience across hundreds of M&A transactions ensures we’re a strong partner when companies start M&A for the first time.

Types of Advisory Engagements

There are six core components of any successful M&A process:

- Developing a clear M&A strategy and rationale

- Mapping the market to find the right opportunity

- Conducting valuation analysis and diligence

- Negotiating and executing the deal

- Financing (via debt and equity)

- Consolidating and post-merger integration

Our M&A experts support every stage of the process to ensure a successful outcome. Scale Up, Take Off with our capital and expertise.

Featured Content

Next Sector: EdTech

THIS IS NOT AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES. The information and opinions contained in this presentation are for background purposes only, is subject to change without notice, and do not purport to be full or complete and Insight has no obligation to update it. No reliance may be placed for any purpose on the information or opinions contained in this presentation or their accuracy or completeness. Certain statements made throughout this Presentation that are not historical facts may contain forward-looking statements regarding the intentions, expectations, objectives and targets of the relevant funds. Any such forward-looking statements are based on assumptions that Insight believes to be reasonable, but are subject to a wide range of risks and uncertainties and, therefore, there can be no assurance that actual results may not differ from those expressed or implied by such forward-looking statements. There is no guarantee that future Insight funds will have access to similar investment opportunities or that such investment opportunities will be profitable or as profitable. The above statements reflect Insight’s opinions about the current state and future of this sector, which are based on its research and experience and that it believes to be reasonable. Investment in securities involves risk and value of investments and income derived from such investments may fluctuate. Past performance is not an indication or guarantee of future results. Trends are not guaranteed to continue. The Recent Investments reflect Insight’s four most recent investments in the sector.

Insight Partners believes that learning is a lifelong endeavor and has invested $2B+ in EdTech companies that seek to support knowledge and skills expansion.

We’ve been tracking 9,653 EdTech startups and ScaleUps since 2014.

With our deep industry experience, we’ve selected 30+ high-quality EdTech companies that we believe are transforming the industry.

Insight Onsite

We are software operators. We specialize in helping Founders and leaders navigate the ScaleUp chasm.

Onsite’s Sales & Customer Success Center of Excellence team has walked in your shoes. We’ve carried a bag and owned the number. Our sales leaders help ScaleUps develop GTM strategy, refine sales processes, and troubleshoot execution challenges. Our customer success leaders know how to deliver upsell, cross-sell, and high retention.

Types of Advisory Engagements

- Sales Capacity Planning and Territory Design: Advisory and tools to determine the number of sellers and sales support to achieve your growth goals.

- Forecasting and Pipeline Management: Best practices that run the gamut from discovery to pipeline review and forecast management; our operators ensure you’re well positioned to meet quarterly and annual goals.

- Process Optimization: Agile strategies to optimize Go-to-Market processes including Lead-to-Quote and Quote-to-Cash. Through our expert advice, ScaleUps remove waste and bottlenecks in these processes to improve time to value by as much, or more, than 25%.

- Channel Development and Management: Strategic advisory to build alternative channels to market via distributors, system integrators, and resellers.

- Churn Mitigation and Customer Expansion: Strategies and tactics to address customer churn and build a sustainable expansion process.

Onsite’s Marketing Center of Excellence supports ScaleUp growth through right-sized marketing strategies and tactics. We can help build a memorable brand, scale your marketing team and strategy, and create a demand generation plan that delivers pipeline.

Types of Advisory Engagements

- Brand Transformation: Frameworks and advisory to activate an effective brand that drives sustained business growth.

- Analyst Relations: Strategic advisory to build analyst relations foundations or increase the impact of an existing AR strategy.

- ABX Advisory: Know-how for account-based experience (ABX) strategies that drive valuable personalized experience to key personas at priority accounts.

- B2C Advisory: Tactical and foundational offerings that drive sustainable growth for our consumer-focused ScaleUps.

- Budgeting and Planning: Expense guidance so that marketing is appropriately resourced to support business goals.

Onsite’s Talent Center of Excellence team knows that people are a critical driver of company growth. As revenue grows, so does team size, and recruiting becomes essential to company success. We help companies source, attract, and retain top talent — from individual contributors to the C-suite — as well as establish robust human capital practices to ensure founders can scale their organization and culture over time.

Types of Advisory Engagements

- Executive Talent Pipeline: We introduce the best executives to help you scale.

- Individual Contributor Technologist Pipeline: Our programs help build the best tech teams to achieve your product vision.

- Executive Recruiting Support: Systematic processes and C-level interviews to help you make the right talent decisions.

- Untapped Talent Pipeline: Best practice advice on how to foster diverse and inclusive teams as core to a winning culture.

- HR and People Advisory: Strategic advisory for people engagement and retention.

- Organization Design: Guidance on how to build team structures that are efficient and scale over time.

Onsite’s Product & Technology Center of Excellence experts work with software leaders to plan and execute their product and technology roadmap. With operating experience across sectors and company sizes, our know-how supports ScaleUps as they build products that can win in the market while scaling successfully through multiple stages of growth.

Types of Advisory Engagements

- Product Strategy: Product strategy and roadmaps that align with your ScaleUp’s objectives to win.

- Technology and Architecture: Engineering excellence across software engineering practices, including cloud architecture design, DevOps, and security.

- Pricing and Packaging: Strategies to deploy a significant growth lever through price execution, freemium, and packaging strategies.

- R&D Operations: Advisory to measure, analyze, report, and execute with the most effective processes, tools, and systems.

Selling to enterprise buyers can be challenging without executive sponsorship and access to decision-makers. Insight Partners for Enterprise bridges this gap through our network and relationships with over 5,000 Global 2000 IT executives. We make introductions so that our companies get the opportunity to drive real revenue.

Types of Advisory Engagements

- Enterprise Introductions: Benefit from qualified enterprise buyer introductions.

- Brand Exposure: Receive brand exposure through Insight’s events and partner-level relationships

- Executive Feedback: Obtain messaging feedback from C-suite leaders.

- Valuable Relationships: Engage with potential advisory and board members.

Insight Partners’ Diligence and Growth Strategy team works with portfolio companies from initial due diligence, through the moment of investment and alongside each ScaleUp’s growth journey. We create engagement plans to support your growth objectives using Insight’s broad network, our market knowledge, and our software-specific Centers of Excellence. Our goal is to anticipate the advice you need, at the right time, and to realize maximum impact.

Before joining Insight, we worked at brand-name consulting firms. Now we deploy our expertise at high-growth software companies by advising CEOs, Founders and leadership teams on their most important challenges. We’re on site, alongside, and with you every step of the way.

Types of Advisory Engagements

- Board meeting and fund-raising materials

- FP&A, including efficiency benchmarks and business operations

- Budgeting and strategic planning

- M&A target identification, due diligence, and post-merger integration

- Exit planning and data-room execution

Onsite’s diligence & growth strategy team and Center of Excellence operators have tailored blueprints, playbooks, workshops, programs and content to help you scale up, so that you can take off.

M&A is a great lever to scale rapidly. Every year, Insight supports dozens of add-on acquisitions across our portfolio. M&A can be an effective strategy to grow products and services, expand geographical footprint, acquihire for talent, and increase market share. Insight’s years of experience across hundreds of M&A transactions ensures we’re a strong partner when companies start M&A for the first time.

Types of Advisory Engagements

There are six core components of any successful M&A process:

- Developing a clear M&A strategy and rationale

- Mapping the market to find the right opportunity

- Conducting valuation analysis and diligence

- Negotiating and executing the deal

- Financing (via debt and equity)

- Consolidating and post-merger integration

Our M&A experts support every stage of the process to ensure a successful outcome. Scale Up, Take Off with our capital and expertise.

Next Sector: Fintech

THIS IS NOT AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES. The information and opinions contained in this presentation are for background purposes only, is subject to change without notice, and do not purport to be full or complete and Insight has no obligation to update it. No reliance may be placed for any purpose on the information or opinions contained in this presentation or their accuracy or completeness. Certain statements made throughout this Presentation that are not historical facts may contain forward-looking statements regarding the intentions, expectations, objectives and targets of the relevant funds. Any such forward-looking statements are based on assumptions that Insight believes to be reasonable, but are subject to a wide range of risks and uncertainties and, therefore, there can be no assurance that actual results may not differ from those expressed or implied by such forward-looking statements. There is no guarantee that future Insight funds will have access to similar investment opportunities or that such investment opportunities will be profitable or as profitable. The above statements reflect Insight’s opinions about the current state and future of this sector, which are based on its research and experience and that it believes to be reasonable. Investment in securities involves risk and value of investments and income derived from such investments may fluctuate. Past performance is not an indication or guarantee of future results. Trends are not guaranteed to continue. The Recent Investments reflect Insight’s four most recent investments in the sector.

With $4B+ invested in Fintech globally, Insight Partners believes in the future potential of innovative ScaleUps to transform the financial services market.

We’ve tracked the emergence of 25,203 Fintech startups and ScaleUps since 2014.

Insight is investing behind the shift to digitized financial services, where we believe that several key trends are shaping the market’s evolution.

One trend is innovative forms of payment that provide cheaper, faster, safer, and easier-to-use alternatives to legacy systems. Banking-as-a-Service (BaaS) solutions make it easier for non-banks to launch new, embedded finance products. Embedded finance — whether from a retailer, airline, or money management app — makes financial services faster and more convenient for consumers. This also provides cheaper access to credit for millions of unbanked or under-banked people.

A further area of innovation are the partnerships between traditional financial institutions and Fintech startups, as traditional institutions are disrupting their own processes to improve automation, security, customer experience, and fraud detection.

With our deep industry experience, we’ve selected 90+ high-quality Fintech companies that we believe are transforming the industry.

Insight Onsite

We are software operators. We specialize in helping Founders and leaders navigate the ScaleUp chasm.

Onsite’s Sales & Customer Success Center of Excellence team has walked in your shoes. We’ve carried a bag and owned the number. Our sales leaders help ScaleUps develop GTM strategy, refine sales processes, and troubleshoot execution challenges. Our customer success leaders know how to deliver upsell, cross-sell, and high retention.

Types of Advisory Engagements

- Sales Capacity Planning and Territory Design: Advisory and tools to determine the number of sellers and sales support to achieve your growth goals.

- Forecasting and Pipeline Management: Best practices that run the gamut from discovery to pipeline review and forecast management; our operators ensure you’re well positioned to meet quarterly and annual goals.

- Process Optimization: Agile strategies to optimize Go-to-Market processes including Lead-to-Quote and Quote-to-Cash. Through our expert advice, ScaleUps remove waste and bottlenecks in these processes to improve time to value by as much, or more, than 25%.

- Channel Development and Management: Strategic advisory to build alternative channels to market via distributors, system integrators, and resellers.

- Churn Mitigation and Customer Expansion: Strategies and tactics to address customer churn and build a sustainable expansion process.

Onsite’s Marketing Center of Excellence supports ScaleUp growth through right-sized marketing strategies and tactics. We can help build a memorable brand, scale your marketing team and strategy, and create a demand generation plan that delivers pipeline.

Types of Advisory Engagements

- Brand Transformation: Frameworks and advisory to activate an effective brand that drives sustained business growth.

- Analyst Relations: Strategic advisory to build analyst relations foundations or increase the impact of an existing AR strategy.

- ABX Advisory: Know-how for account-based experience (ABX) strategies that drive valuable personalized experience to key personas at priority accounts.

- B2C Advisory: Tactical and foundational offerings that drive sustainable growth for our consumer-focused ScaleUps.

- Budgeting and Planning: Expense guidance so that marketing is appropriately resourced to support business goals.

Onsite’s Talent Center of Excellence team knows that people are a critical driver of company growth. As revenue grows, so does team size, and recruiting becomes essential to company success. We help companies source, attract, and retain top talent — from individual contributors to the C-suite — as well as establish robust human capital practices to ensure founders can scale their organization and culture over time.

Types of Advisory Engagements

- Executive Talent Pipeline: We introduce the best executives to help you scale.

- Individual Contributor Technologist Pipeline: Our programs help build the best tech teams to achieve your product vision.

- Executive Recruiting Support: Systematic processes and C-level interviews to help you make the right talent decisions.

- Untapped Talent Pipeline: Best practice advice on how to foster diverse and inclusive teams as core to a winning culture.

- HR and People Advisory: Strategic advisory for people engagement and retention.

- Organization Design: Guidance on how to build team structures that are efficient and scale over time.

Onsite’s Product & Technology Center of Excellence experts work with software leaders to plan and execute their product and technology roadmap. With operating experience across sectors and company sizes, our know-how supports ScaleUps as they build products that can win in the market while scaling successfully through multiple stages of growth.

Types of Advisory Engagements

- Product Strategy: Product strategy and roadmaps that align with your ScaleUp’s objectives to win.

- Technology and Architecture: Engineering excellence across software engineering practices, including cloud architecture design, DevOps, and security.

- Pricing and Packaging: Strategies to deploy a significant growth lever through price execution, freemium, and packaging strategies.

- R&D Operations: Advisory to measure, analyze, report, and execute with the most effective processes, tools, and systems.

Selling to enterprise buyers can be challenging without executive sponsorship and access to decision-makers. Insight Partners for Enterprise bridges this gap through our network and relationships with over 5,000 Global 2000 IT executives. We make introductions so that our companies get the opportunity to drive real revenue.

Types of Advisory Engagements

- Enterprise Introductions: Benefit from qualified enterprise buyer introductions.

- Brand Exposure: Receive brand exposure through Insight’s events and partner-level relationships

- Executive Feedback: Obtain messaging feedback from C-suite leaders.

- Valuable Relationships: Engage with potential advisory and board members.

Insight Partners’ Diligence and Growth Strategy team works with portfolio companies from initial due diligence, through the moment of investment and alongside each ScaleUp’s growth journey. We create engagement plans to support your growth objectives using Insight’s broad network, our market knowledge, and our software-specific Centers of Excellence. Our goal is to anticipate the advice you need, at the right time, and to realize maximum impact.

Before joining Insight, we worked at brand-name consulting firms. Now we deploy our expertise at high-growth software companies by advising CEOs, Founders and leadership teams on their most important challenges. We’re on site, alongside, and with you every step of the way.

Types of Advisory Engagements

- Board meeting and fund-raising materials

- FP&A, including efficiency benchmarks and business operations

- Budgeting and strategic planning

- M&A target identification, due diligence, and post-merger integration

- Exit planning and data-room execution

Onsite’s diligence & growth strategy team and Center of Excellence operators have tailored blueprints, playbooks, workshops, programs and content to help you scale up, so that you can take off.

M&A is a great lever to scale rapidly. Every year, Insight supports dozens of add-on acquisitions across our portfolio. M&A can be an effective strategy to grow products and services, expand geographical footprint, acquihire for talent, and increase market share. Insight’s years of experience across hundreds of M&A transactions ensures we’re a strong partner when companies start M&A for the first time.

Types of Advisory Engagements

There are six core components of any successful M&A process:

- Developing a clear M&A strategy and rationale

- Mapping the market to find the right opportunity

- Conducting valuation analysis and diligence

- Negotiating and executing the deal

- Financing (via debt and equity)

- Consolidating and post-merger integration

Our M&A experts support every stage of the process to ensure a successful outcome. Scale Up, Take Off with our capital and expertise.

Featured Content

Next Sector: Future of Work

THIS IS NOT AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES. The information and opinions contained in this presentation are for background purposes only, is subject to change without notice, and do not purport to be full or complete and Insight has no obligation to update it. No reliance may be placed for any purpose on the information or opinions contained in this presentation or their accuracy or completeness. Certain statements made throughout this Presentation that are not historical facts may contain forward-looking statements regarding the intentions, expectations, objectives and targets of the relevant funds. Any such forward-looking statements are based on assumptions that Insight believes to be reasonable, but are subject to a wide range of risks and uncertainties and, therefore, there can be no assurance that actual results may not differ from those expressed or implied by such forward-looking statements. There is no guarantee that future Insight funds will have access to similar investment opportunities or that such investment opportunities will be profitable or as profitable. The above statements reflect Insight’s opinions about the current state and future of this sector, which are based on its research and experience and that it believes to be reasonable. Investment in securities involves risk and value of investments and income derived from such investments may fluctuate. Past performance is not an indication or guarantee of future results. Trends are not guaranteed to continue. The Recent Investments reflect Insight’s four most recent investments in the sector.

Insight Partners has committed $1B+ to software innovators that we believe provide flexible, engaging, and smarter work.

We’ve followed 2,796 Future of Work startups and ScaleUps since 2014.

The COVID-19 pandemic has led to significant changes in the way we work. This unprecedented event drove a confluence of innovation around digital collaboration and remote work – it has transformed the notion of where work can get done and how teams can operate effectively.

Insight invested into companies building on trends like flexible work and effective collaboration resulting from Gen Z entering the workforce. We are excited about companies using the same approach to innovation that they use with customers: to improve how they work internally. We believe that The Future of Work represents a global investment opportunity.

With our deep industry experience, we’ve selected 20+ high-quality Future of Work companies that we believe are transforming the industry.

Insight Onsite

We are software operators. We specialize in helping Founders and leaders navigate the ScaleUp chasm.

Onsite’s Sales & Customer Success Center of Excellence team has walked in your shoes. We’ve carried a bag and owned the number. Our sales leaders help ScaleUps develop GTM strategy, refine sales processes, and troubleshoot execution challenges. Our customer success leaders know how to deliver upsell, cross-sell, and high retention.

Types of Advisory Engagements

- Sales Capacity Planning and Territory Design: Advisory and tools to determine the number of sellers and sales support to achieve your growth goals.

- Forecasting and Pipeline Management: Best practices that run the gamut from discovery to pipeline review and forecast management; our operators ensure you’re well positioned to meet quarterly and annual goals.

- Process Optimization: Agile strategies to optimize Go-to-Market processes including Lead-to-Quote and Quote-to-Cash. Through our expert advice, ScaleUps remove waste and bottlenecks in these processes to improve time to value by as much, or more, than 25%.

- Channel Development and Management: Strategic advisory to build alternative channels to market via distributors, system integrators, and resellers.

- Churn Mitigation and Customer Expansion: Strategies and tactics to address customer churn and build a sustainable expansion process.

Onsite’s Marketing Center of Excellence supports ScaleUp growth through right-sized marketing strategies and tactics. We can help build a memorable brand, scale your marketing team and strategy, and create a demand generation plan that delivers pipeline.

Types of Advisory Engagements

- Brand Transformation: Frameworks and advisory to activate an effective brand that drives sustained business growth.

- Analyst Relations: Strategic advisory to build analyst relations foundations or increase the impact of an existing AR strategy.

- ABX Advisory: Know-how for account-based experience (ABX) strategies that drive valuable personalized experience to key personas at priority accounts.

- B2C Advisory: Tactical and foundational offerings that drive sustainable growth for our consumer-focused ScaleUps.

- Budgeting and Planning: Expense guidance so that marketing is appropriately resourced to support business goals.

Onsite’s Talent Center of Excellence team knows that people are a critical driver of company growth. As revenue grows, so does team size, and recruiting becomes essential to company success. We help companies source, attract, and retain top talent — from individual contributors to the C-suite — as well as establish robust human capital practices to ensure founders can scale their organization and culture over time.

Types of Advisory Engagements

- Executive Talent Pipeline: We introduce the best executives to help you scale.

- Individual Contributor Technologist Pipeline: Our programs help build the best tech teams to achieve your product vision.

- Executive Recruiting Support: Systematic processes and C-level interviews to help you make the right talent decisions.

- Untapped Talent Pipeline: Best practice advice on how to foster diverse and inclusive teams as core to a winning culture.

- HR and People Advisory: Strategic advisory for people engagement and retention.

- Organization Design: Guidance on how to build team structures that are efficient and scale over time.

Onsite’s Product & Technology Center of Excellence experts work with software leaders to plan and execute their product and technology roadmap. With operating experience across sectors and company sizes, our know-how supports ScaleUps as they build products that can win in the market while scaling successfully through multiple stages of growth.

Types of Advisory Engagements

- Product Strategy: Product strategy and roadmaps that align with your ScaleUp’s objectives to win.

- Technology and Architecture: Engineering excellence across software engineering practices, including cloud architecture design, DevOps, and security.

- Pricing and Packaging: Strategies to deploy a significant growth lever through price execution, freemium, and packaging strategies.

- R&D Operations: Advisory to measure, analyze, report, and execute with the most effective processes, tools, and systems.

Selling to enterprise buyers can be challenging without executive sponsorship and access to decision-makers. Insight Partners for Enterprise bridges this gap through our network and relationships with over 5,000 Global 2000 IT executives. We make introductions so that our companies get the opportunity to drive real revenue.

Types of Advisory Engagements

- Enterprise Introductions: Benefit from qualified enterprise buyer introductions.

- Brand Exposure: Receive brand exposure through Insight’s events and partner-level relationships

- Executive Feedback: Obtain messaging feedback from C-suite leaders.

- Valuable Relationships: Engage with potential advisory and board members.

Insight Partners’ Diligence and Growth Strategy team works with portfolio companies from initial due diligence, through the moment of investment and alongside each ScaleUp’s growth journey. We create engagement plans to support your growth objectives using Insight’s broad network, our market knowledge, and our software-specific Centers of Excellence. Our goal is to anticipate the advice you need, at the right time, and to realize maximum impact.

Before joining Insight, we worked at brand-name consulting firms. Now we deploy our expertise at high-growth software companies by advising CEOs, Founders and leadership teams on their most important challenges. We’re on site, alongside, and with you every step of the way.

Types of Advisory Engagements

- Board meeting and fund-raising materials

- FP&A, including efficiency benchmarks and business operations

- Budgeting and strategic planning

- M&A target identification, due diligence, and post-merger integration

- Exit planning and data-room execution

Onsite’s diligence & growth strategy team and Center of Excellence operators have tailored blueprints, playbooks, workshops, programs and content to help you scale up, so that you can take off.

M&A is a great lever to scale rapidly. Every year, Insight supports dozens of add-on acquisitions across our portfolio. M&A can be an effective strategy to grow products and services, expand geographical footprint, acquihire for talent, and increase market share. Insight’s years of experience across hundreds of M&A transactions ensures we’re a strong partner when companies start M&A for the first time.

Types of Advisory Engagements

There are six core components of any successful M&A process:

- Developing a clear M&A strategy and rationale

- Mapping the market to find the right opportunity

- Conducting valuation analysis and diligence

- Negotiating and executing the deal

- Financing (via debt and equity)

- Consolidating and post-merger integration

Our M&A experts support every stage of the process to ensure a successful outcome. Scale Up, Take Off with our capital and expertise.

Featured Content

Next Sector: Gaming