What founders can learn from the 2024 State of Enterprise Tech Report

In our 2024 State of Enterprise Tech Report, Insight surveyed 421 senior tech leaders from companies including Bayer, United, the Cigna Group, and more — representing trillions of dollars in revenue. Not only does this data offer leading perspectives on budget shifts and current investments but also key priorities among enterprise buyers.

By interpreting enterprise buyers’ latest trends and concerns, founders and ScaleUp leaders can craft targeted, resonant strategies that anticipate market demands. These buyer insights span four key domains: Data & AI, Infrastructure and Dev Ecosystem, Digital Experience, and Cybersecurity.

Increased focus on custom AI

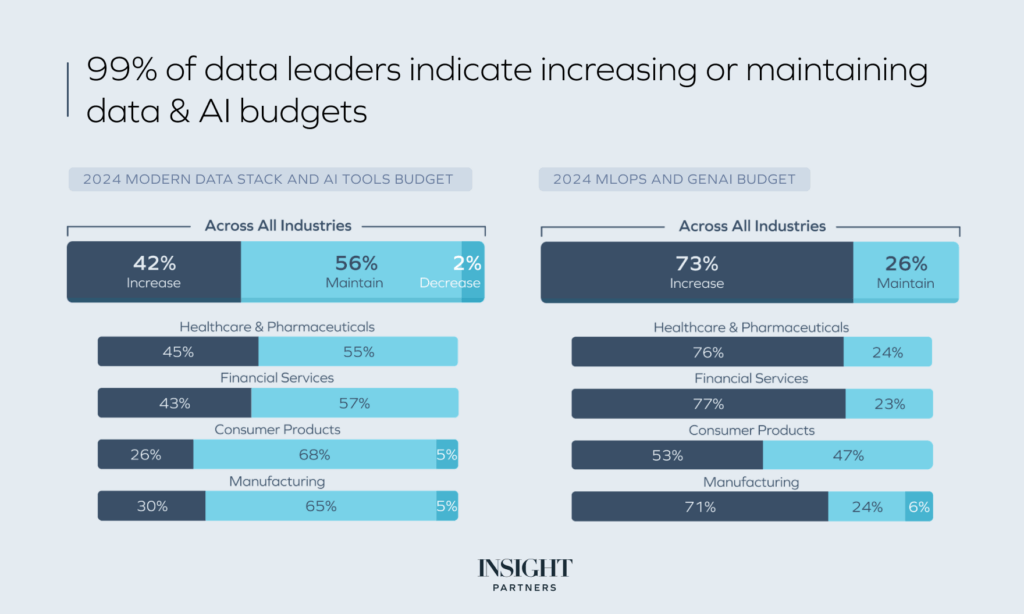

99% of enterprise data leaders indicate increasing or maintaining data & AI budgets. Enterprises are significantly investing in customizing AI models, recognizing the value of tailoring these technologies to meet specific needs. In fact, 48% of data leaders are actively fine-tuning and customizing open-source or out-of-the-box foundational models to better fit their organizational requirements.

This trend underscores the strategic emphasis on developing a robust foundational data layer, which has become a top priority for many.

Top investments include:

- Data warehousing and lakes

- AI model development

- BI/Analytics and visualization

- AI GRC

- Data preparation

Aligning on generative AI across organizations

OpenAI’s models have emerged as the most adopted in this space, with 43% of respondents using ChatGPT-4 and 36% using ChatGPT-3.5. Close behind are open-source large language models (LLMs) that offer the flexibility to be customized for specialized domains, providing enterprises with tailored solutions that address unique challenges.

Critical to the successful adoption of generative AI within enterprises is obtaining comprehensive buy-in across the organization. To achieve this, 56% of data leaders have either established or are planning to establish hybrid AI Centers of Excellence (CoE). These CoEs play a pivotal role in aligning internal business units with a centralized AI strategy, ensuring that the deployment of AI technologies is cohesive and strategically integrated into the broader business objectives.

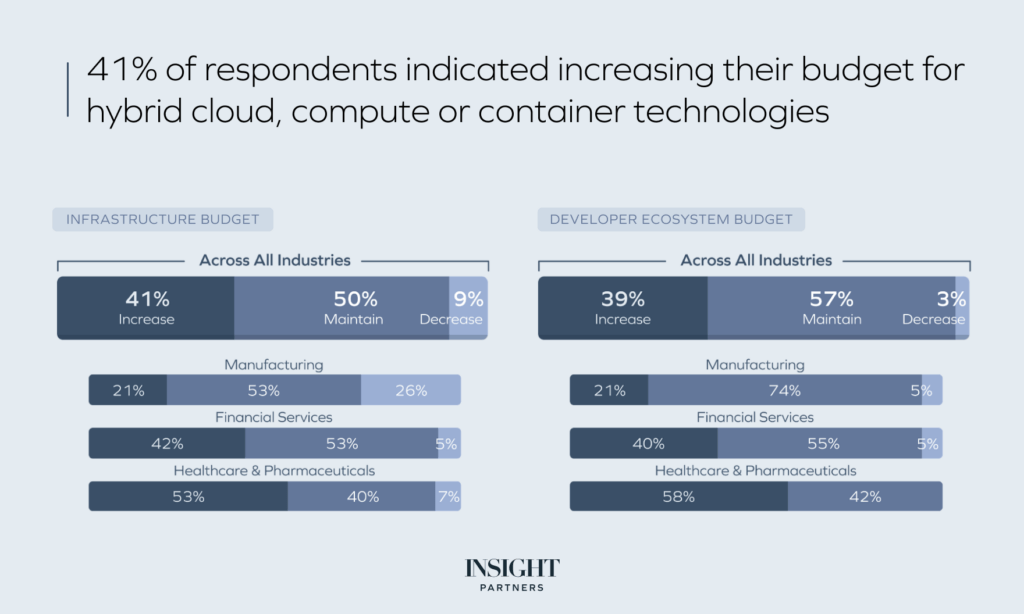

Investments in cloud continue to increase

The rapid adoption of cloud technologies is revolutionizing the way enterprises operate, offering scalability and cost efficiencies through hybrid and multi-cloud environments. An overwhelming 91% of tech leaders are either increasing or maintaining their budgets for hybrid cloud, compute, or container technologies.

In an effort to improve scalability, leaders are reimagining their IT architecture, placing significant emphasis on Continuous Integration/Continuous Deployment (CI/CD), Infrastructure as Code (IaC), and serverless technology. Currently, 68% of tech leaders have implemented and are actively using CI/CD pipelines, while 62% have deployed serverless technology, underscoring a shift towards more agile solutions.

“There are three key reasons to move your applications to the cloud. First, it allows you to innovate faster on behalf of your customers. Second, it can provide greater security, resiliency and flexibility. Finally, cloud done right can be highly cost-effective.”

— Mahmoud ElAssir, Chief Technology Officer, UnitedHealth Group

Tech leaders want to reduce coding time and improve code quality

A key focus for enterprise leaders is enhancing infrastructure resilience and flexibility. Leaders are ramping up investments in API orchestration, security, and AI integrations to build robust and adaptable systems. Additionally, the use of AI copilots and agents in software development is on the rise, with tech leaders seeking to reduce coding time and improve workflow and code quality. Specifically, 72% aim to cut down on coding time, 60% strive to streamline the development process, and another 60% focus on increasing code quality.

Prioritizing L&D and Employee Performance and Productivity

Enterprise leaders are increasingly leveraging advanced data analytics and automation to enhance customer satisfaction and engagement. The primary focus areas include Customer Data Management, Customer Analytics, Digital Communications and Virtual Agents, and Customer Service Automation. By prioritizing these areas, organizations aim to deliver more personalized and efficient customer experiences.

This year has seen a significant push to improve Learning & Development (L&D) and better define and support Employee Performance and Productivity. In 2024, 51% of leaders have identified L&D as a top priority, compared to 29% in 2023. Similarly, 65% of leaders now consider Employee Performance and Productivity a top priority, up from 36% in 2023. This shift highlights a growing recognition of the importance of investing in employee growth and operational efficiency.

Finding CX and EX use cases for AI

Despite these advancements, only half of digital leaders feel they are deriving value from their automation investments. The primary barriers cited include scalability issues, implementation challenges, and high costs.

However, the adoption of AI copilots is gaining traction, with 95% of leaders reporting they have identified clear use cases for this technology. The top three use cases are for general purposes, employee service, and developer-focused applications.

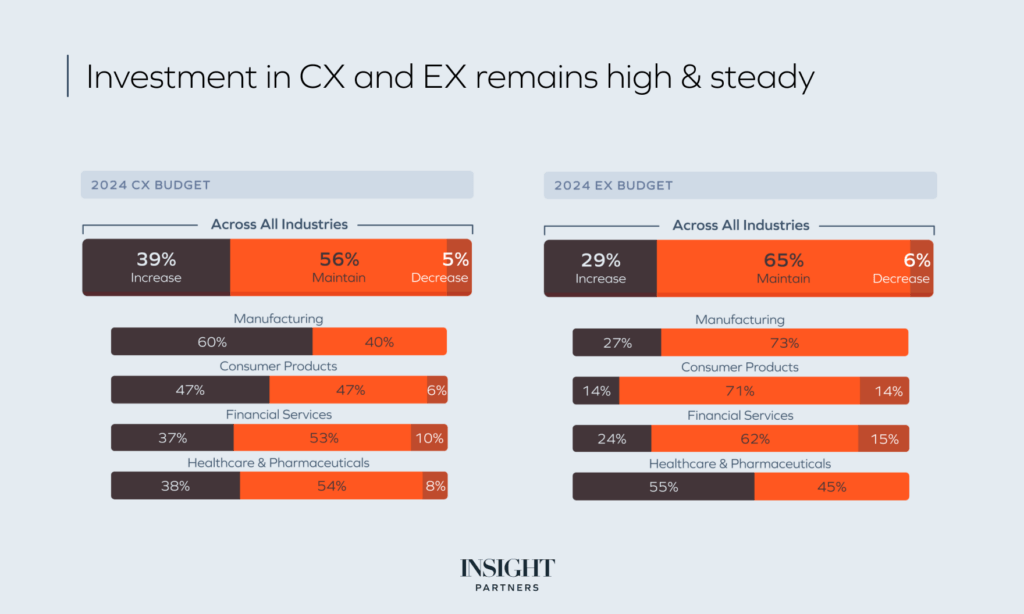

Most respondents have been directing budgets toward technology that enhances CX and steadily increasing investment in internal technology as their modernization initiatives progress. It comes as no surprise that budgets for these areas remain intact or are up from 2023 as new solutions emerge to solve enterprise-level challenges.

Cybersecurity is a top priority, and demand remains strong

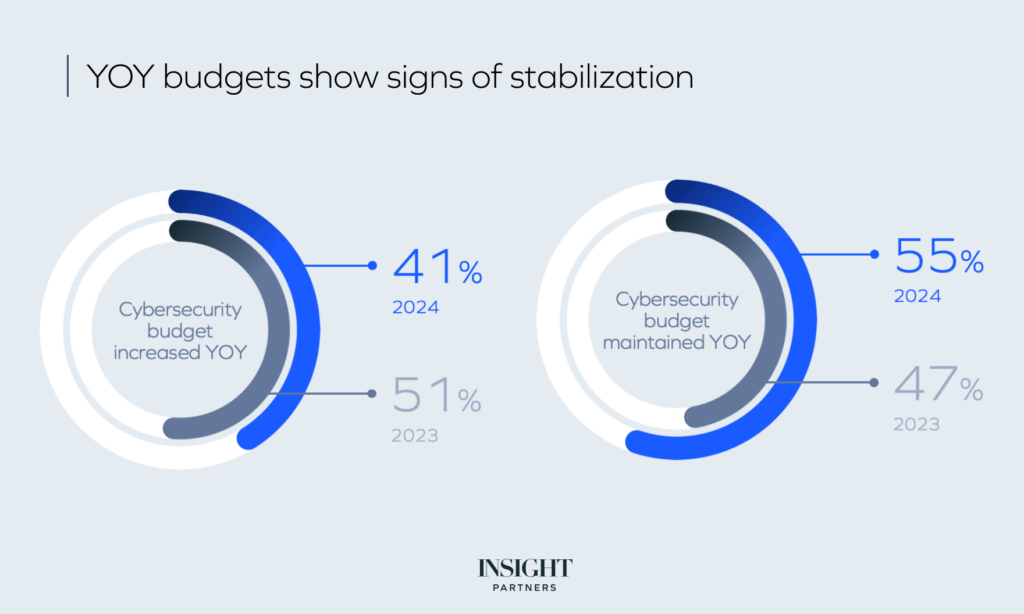

Cybersecurity is still a top enterprise priority, and so where possible, cybersecurity leaders have protected their budgets, with the majority maintaining budget allocation into 2024.

Budgets for cybersecurity haven’t been immune to challenging macro conditions, and rising base costs mean that CISOs are actively considering consolidation and automation.

Despite a slowdown in year-over-year budget growth, the demand for cybersecurity innovation remains strong. In 2024, 41% of cybersecurity leaders plan to increase their budgets, down from 51% in 2023. However, a significant 64% are boosting their budgets specifically for change and innovation, indicating a focused commitment to advancing their cybersecurity capabilities.

“Companies will need to continue to invest in cybersecurity. The level of sophistication of threat actors is increasing, and as an airline industry, we need to fully resource our response to that ever-growing threat.” — Jason Birnbaum, Chief Information Officer, United Airlines

Cloud security is top of mind for cybersecurity SaaS leaders

Cloud security is a top priority, with 49% of cybersecurity leaders highlighting it as one of their top three budgetary focuses. Key areas within this priority include Cloud Platform Security, Security Operations (SecOps) and Threat Management, and Identity and Access Management (IAM). These areas are critical as organizations continue to migrate to cloud environments and face increasingly sophisticated threats.

Security Operations (SecOps) is seen as having the greatest potential to benefit from Generative AI (GenAI). Cybersecurity leaders are exploring how GenAI can enhance threat detection, response times, and overall operational efficiency.

However, the adoption of AI comes with significant concerns, the foremost being data security. Ensuring controlled access is another major issue, reflecting the need for robust measures to protect sensitive information and manage permissions effectively as AI technologies are integrated into cybersecurity strategies.