The next industrial revolution: How software is shaping the future of production

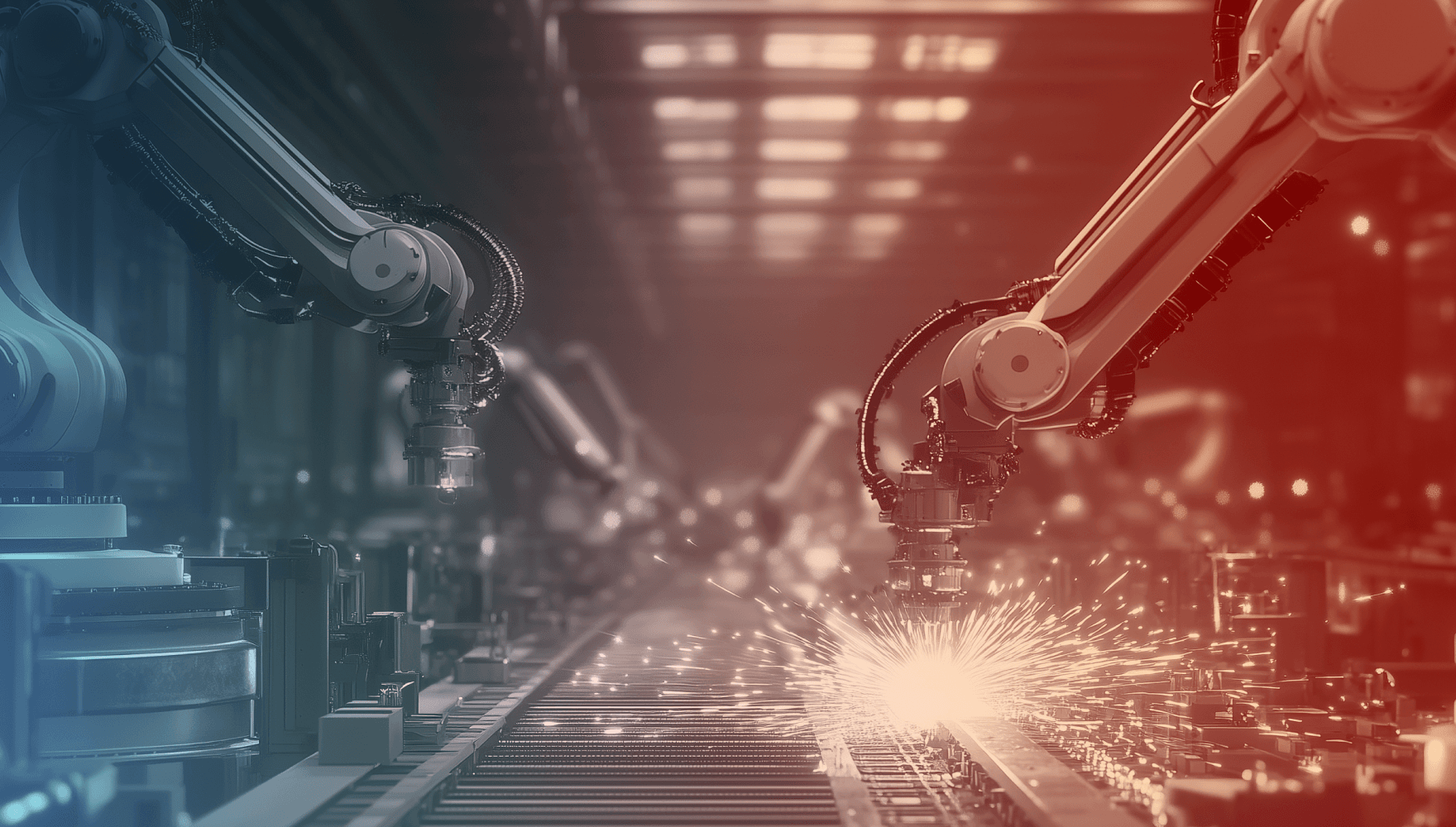

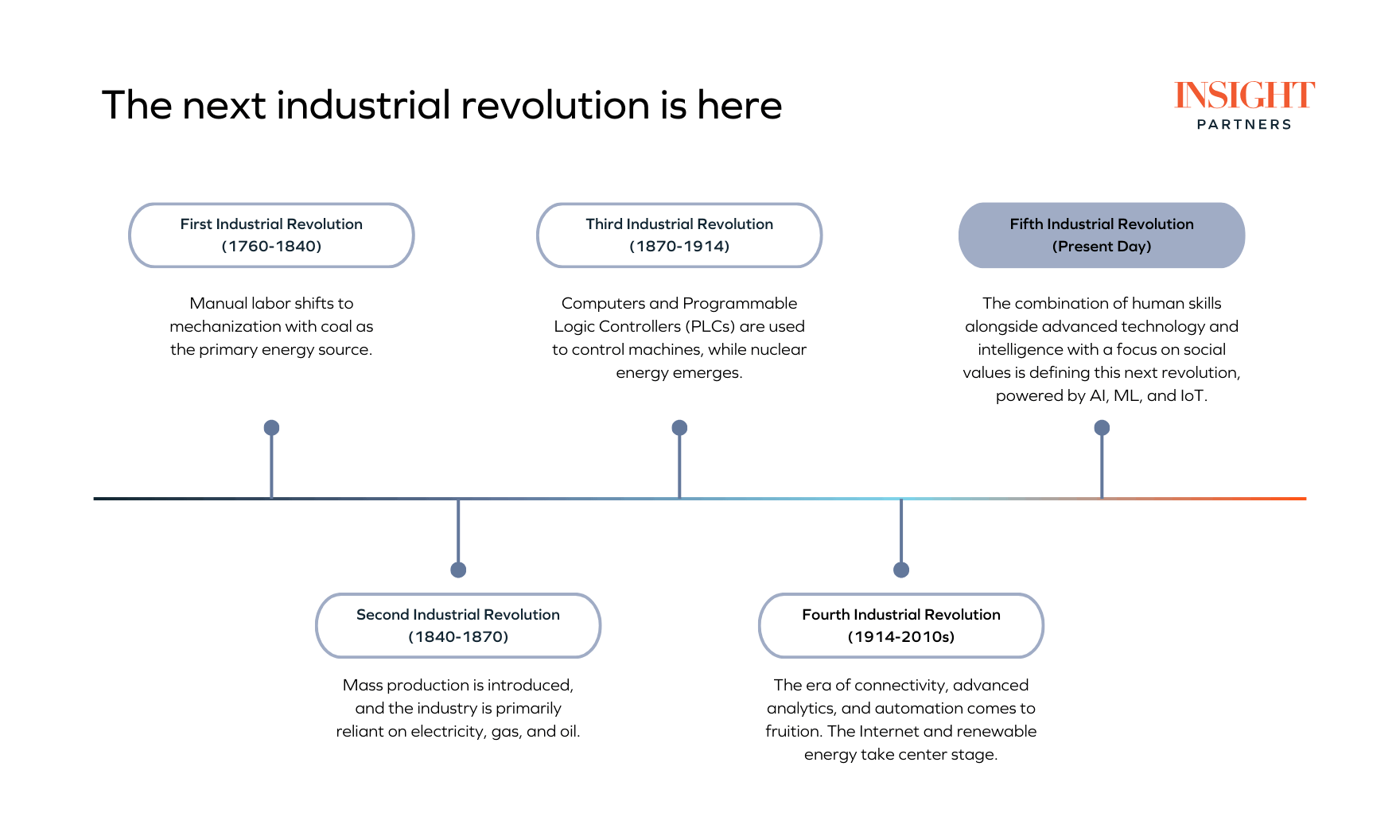

The first industrial revolution marked the shift from manual labor to mechanization. The second introduced mass production, and the third was driven by computers and Programmable Logic Controllers (PLCs) to control machines. The fourth, defining the early 21st century, has been the era of connectivity, advanced analytics, and automation. We at Insight now see a new revolution underway led by humans and augmented by increased sophistication in AI/ML, automation, and IoT — ushering in a new era of industrial productivity.

While other industries have rapidly digitized over the past decade, the industrial and manufacturing sector has seen slower technological adoption. There’s long been cultural resistance toward adopting new tools and software due to the fact that production needs to remain uninterrupted, leaving little room for the downtime required to implement large-scale upgrades.

But now, facing existential labor shortages, lingering supply chain disruptions, and increasing pressure from ESG regulations, the industry is increasingly embracing technological innovation to meet these challenges, thereby creating a big opportunity.

At Insight Partners, we’re excited by the opportunities of software digitizing, optimizing, and accelerating efficiency across the industrials and manufacturing landscape and look forward to adding to our growing roster of investments in the sector.

The industry

Technological innovations — like AI, ML, IoT, digital twins, and automation — have clear use cases within the industrial context.

IoT devices and sensors increase the volume and granularity of data collection, centralizing it for better analysis and application through AI and ML. Automation and robotics, building on the progress of Programmable Logic Controllers (PLCs), make machines easier to control while increasing efficiency and safety. But automation isn’t about replacing people — it’s about empowering them. The goal is to use technology to help these workers do more with less.

This is all the more important today because the industry is facing a critical labor shortage. The manufacturing sector currently has more than half a million job openings, and an estimated 3.8M additional employees will be needed in manufacturing between 2024 and 2033 as current workers retire or change careers. But up to 1.9M of these positions could remain unfilled if manufacturers aren’t able to address the skills and applicant gaps, threatening U.S. manufacturing growth and competitiveness.

The sector’s aging workforce compounds this problem. Over 51% of U.S. manufacturing jobs are held by employees aged 45 and up, with a quarter of that workforce over the age of 55. As baby boomers retire, finding workers with similar experience and expertise to fill the skills gaps will be challenging, particularly as fewer students are enrolling in vocational programs.

Many industries rely on industrial experience and specialized knowledge, which is disappearing as the workforce retires. But with the demand for such highly skilled employees outweighing supply, the ability to implement and maintain the very technologies that would improve productivity rates may be hindered. It demands technology that can formalize operating procedures and industrial know-how — improving the productivity of the existing workforce and upskilling new entrants.

The investment landscape

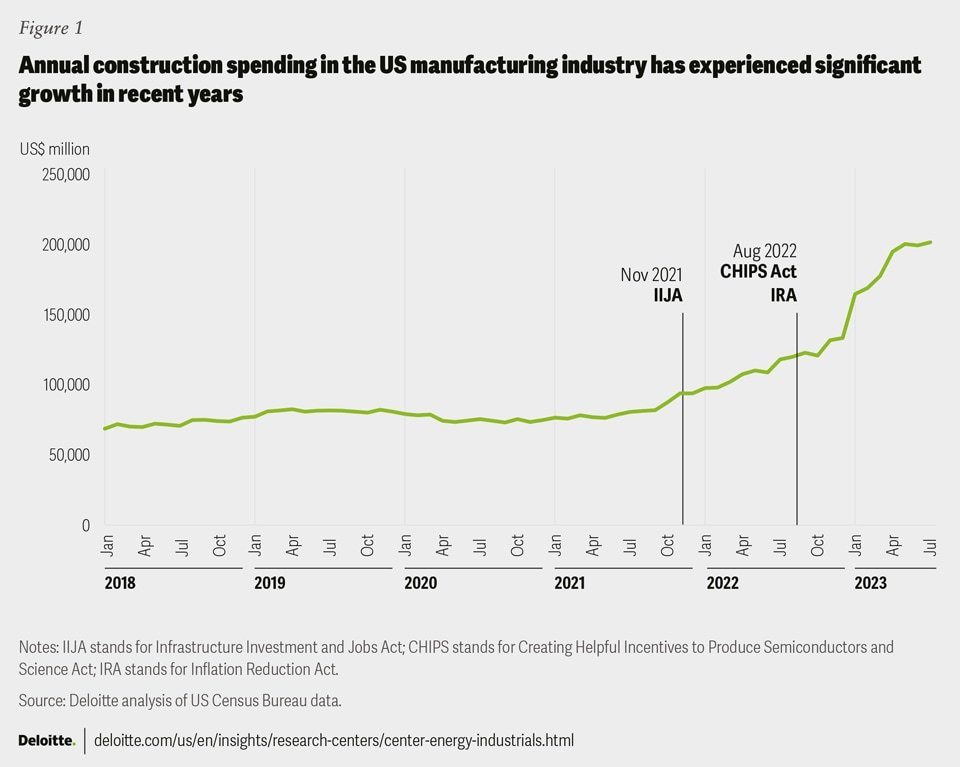

Two major and recent pieces of legislation — the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act and the Inflation Reduction Act (IRA) — have generated a sizable tailwind for the sector. Together, they prioritize rebuilding infrastructure, advancing clean energy initiatives, and building out the domestic semiconductor industry while also fostering job growth and workforce development.

The CHIPS and Science Act authorizes roughly $280B in new funding to boost domestic research and manufacturing of semiconductors in the U.S. Since the Act’s passage in August 2022, over $210B in private investments for semiconductor projects have been announced across 20 states.

The IRA, primarily focused on clean energy and climate change initiatives, also has significant implications for manufacturing and industrials. It provides around $370B to bolster sustainability efforts, increase energy security, and lower energy costs. Since the IRA’s passage, close to 200 new clean technology manufacturing facilities have been announced, representing $88B in investment and the potential creation of over 75,000 new jobs.

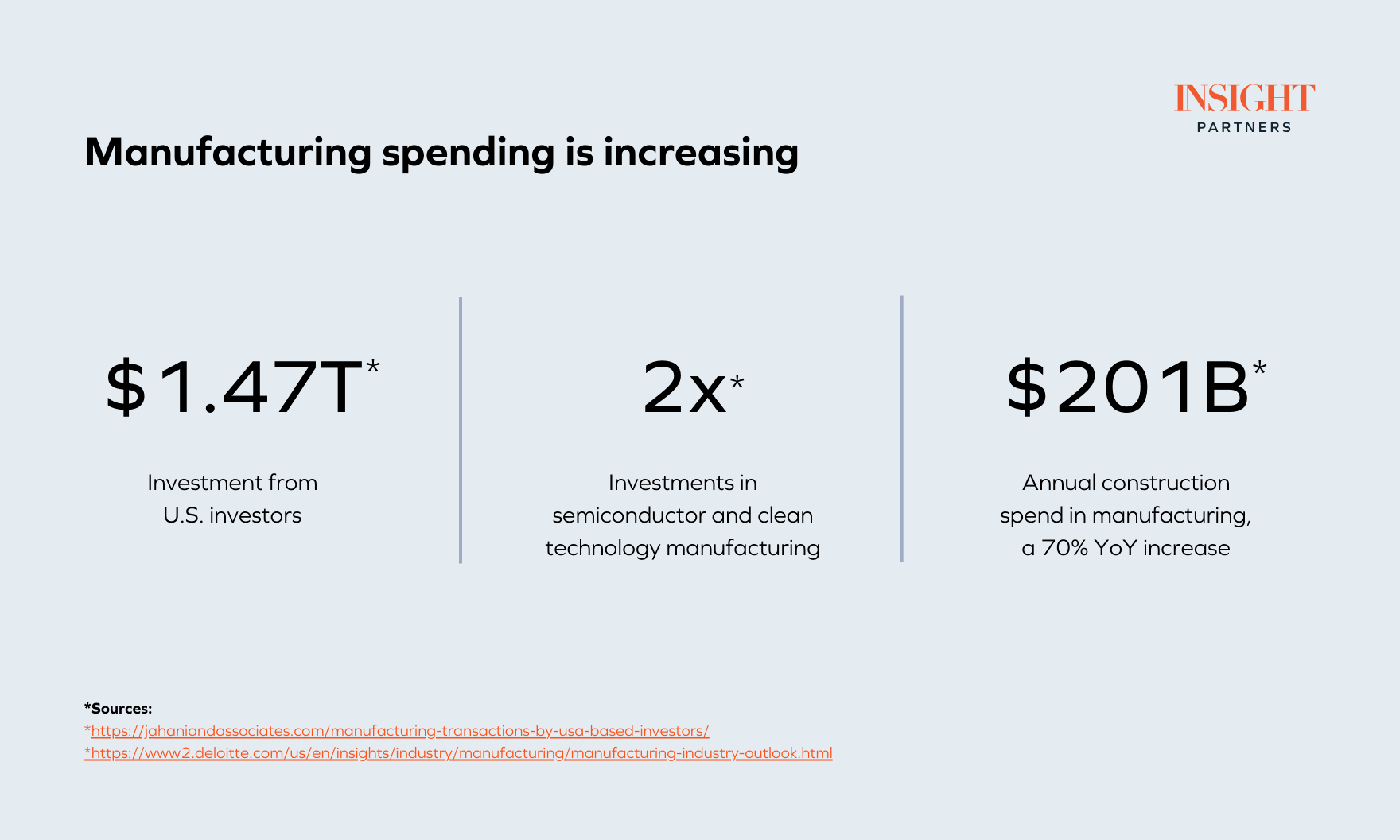

As a result, the manufacturing industry is experiencing record spending and private sector investment. Between Q1 2020 and Q3 2023, the industry received $1.47T in investment from U.S. investors, 71% of which was invested in domestic manufacturing companies. Investments in new technologies have nearly doubled compared to 2021 and are almost 20 times the amount allocated in 2019. And, as of July 2023, annual construction spending in manufacturing reached $201B, a 70% YoY increase, setting the stage for further growth in 2024.

This stimulus and spending means many more new, mid-market industrial companies will emerge. These companies will have more youthful DNA and be ready to adopt technology from the start to streamline their operations alongside legacy incumbents that are forced to reinvent themselves with new-age technology. For example, according to a study conducted by Forbes, “70% of manufacturers say they’ve implemented some form of AI into their operations and that 82% have plans to increase their AI budgets in 2024.”

The opportunities

This combination of industry-specific challenges coupled with technological tailwinds means that the need and opportunity to leverage digital technologies within and around the factory are only growing.

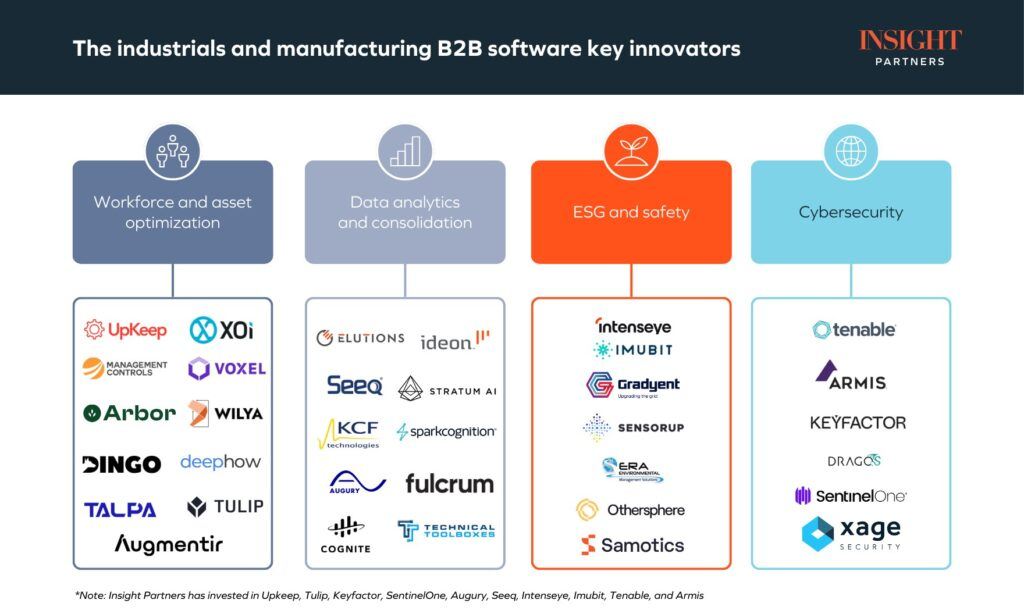

Workforce and asset optimization

Given the labor shortage and skills gap, software that upskills workers is mission-critical to increase productivity and reduce operational redundancies. Given most of these processes are largely manual and paper-based, the opportunity to digitize creates high value and meaningful ROI for customers.

Data analytics and consolidation

In the past decade, the ability to collect, store, and analyze data on an industrial scale has matured.

The sector generates vast amounts of data, but industrial floors are fragmented and often plagued by data silos. This presents a high-value opportunity to aggregate data and provide meaningful insights to operators. At the same time, new regulatory frameworks, like the EU’s Digital Product Passport, which requires detailed information about a product’s lifecycle, are also pushing manufacturers toward better data collection and reporting.

ESG and safety

With increasing pressure and regulations around decarbonization, there is a significant opportunity to use software to make industrial processes greener, safer, and more efficient. Strategies around energy optimization, ESG management and reporting provide meaningful value-add across the board.

Cybersecurity

As the sector further automates and adopts more digital technology, it also introduces new risks and vulnerabilities — and cybersecurity solutions will become increasingly critical in ensuring the safe and efficient operation of manufacturing processes.

Cyber threats have played a part in the cultural reluctance to adopt technology — in a recent study, more than half of surveyed manufacturing companies said they were targeted by ransomware. To mitigate the risks, the sector should prioritize cybersecurity as much as the digital transformation projects themselves.

The innovators

Several companies are already exploring these opportunities.

Workforce and asset optimization

UpKeep* provides asset operations management solutions, including CMMS and enterprise asset management (EAM) software. Their platform supports maintenance and reliability teams in streamlining operations, managing work orders, scheduling preventive maintenance, tracking inventory, and monitoring asset health using real-time data and IoT integrations. Through mobile-first technology and analytics, it helps improve efficiency, reduce downtime, and extend asset lifecycles through mobile-first technology and robust analytics.

XOi is a data integration platform that unifies siloed data to equip technicians with relevant information, schematics, support, and ML-driven repair recommendations — thereby tapping into the industrial know-how lost through the aging workforce and labor shortages. The platform brings together data from OEMs, distributors, and back-office FSM tools into a single pane of glass that is seeing wide adoption and continuous use by front-line technicians.

Management Controls’ myTrack platform is a workforce and safety solution for contingent labor data and spend management across complex and industrial industries. Owners typically rely on pen and paper for coordinating their workforce. myTrack digitizes the process by automating compliance with contract terms; reducing compliance risks and overbilling; and providing tools for labor, equipment, and material tracking.

Arbor (Founded by former Insight Partners employees) is an AI-powered labor intelligence platform for the manufacturing industry. The company takes in HRIS and ATS data to help businesses uncover insights and value on their employees, ultimately driving improvements across hiring, retention, compensation, and engagement and mitigating risks posed by labor shortages.

Data analytics and consolidation

Augury* provides AI-driven predictive maintenance and process optimization solutions for manufacturing. Their technology predicts and prevents machine failures, optimizes production processes, and improves overall operational efficiency to enhance machine health, maximize yield, reduce waste, and achieve sustainable production goals.

Cognite is an industrial DataOps platform aggregating siloed data to drive improvements across data exploration, digital operator rounds, production optimization, turnaround planning, and root-cause analysis. The solution is purpose-built for messy industrial data and uniquely addresses the needs of the sector across energy, process manufacturing and other industrials.

KCF Technologies specializes in machine health optimization for complex industrials. Their SMARTdiagnostics platform integrates IoT, advanced analytics, and user-friendly software to reduce downtime, extend asset life, and enhance overall efficiency.

Seeq* provides advanced analytics and visualization tools supplemented by machine learning and AI solutions for time series data in industrial operations. Seeq’s tools help oil and gas, pharmaceuticals, and manufacturing businesses enhance productivity, achieve sustainability goals, and empower engineers and data scientists with actionable insights.

Technical Toolboxes provides advanced analysis tools for pipeline integrity, crossings, corrosion, and welding. By centralizing data and automating calculations, they help increase productivity, promote compliance, and reduce risk.

ESG and safety

Intenseye* leverages AI technology to enhance workplace safety by monitoring existing cameras to detect and notify safety hazards in real time. Intenseye’s platform offers tools for compliance management, audits, and reporting. In turn, the platform helps reduce incidents, increase operational efficiency, and promote regulatory adherence.

Imubit* specializes in process optimization for the energy industry. Their closed-loop neural network (CLNN) technology helps refineries and petrochemical plants optimize their processes by continuously learning and adapting to changing conditions, integrating with existing systems to provide improved efficiency and reduced energy consumption.

Gradyent focuses on optimizing district heating networks through digital twin technology. The platform creates a virtual model of the heating network, allowing for precise control and optimization of energy use — thus reducing energy waste and improving the overall efficiency of heating systems.

Cybersecurity

Tenable* provides comprehensive exposure management and vulnerability risk management solutions. Its platform enables real-time continuous assessment of an organization’s attack surface, providing risk-based insights on vulnerabilities and recommendations for prioritization and remediation. It also provides specific operational technology security to protect tech on the factory floor.

Armis* provides comprehensive security across various types of assets and networks, offering asset management security, operational technology and IoT security, and vulnerability prioritization and remediation with a focus on both managed and unmanaged devices across manufacturing environments.

The considerations

Here are Insight’s key considerations for founders building a software business within the industrials and manufacturing space.

Anticipate long sales cycles — but sticky customers

Customers in this space are large and complex, which means lengthy and bureaucratic sales cycles. However, once landed customers are sticky with high annual contract values (ACVs) and high upsell potential — and the next customer will be much easier to land. While the initial contract value can start small, value can expand throughout their operations.

A good approach is solving a smaller use case to build trust and using that as a wedge to scale. This requires a low-risk implementation strategy, incrementally deploying applications to address pressing challenges without having to rip and replace existing systems wholesale. Start by targeting one manufacturing plant with one use case, prove the ROI, and then expand the solution.

Land a beachhead client

Landing a beachhead customer is crucial because it establishes credibility and provides a real-world proof of concept. In such a close-knit industry, which is oftentimes reliant on word-of-mouth and references, having one promoter can spark a go-to-market flywheel. This not only accelerates growth but also rapidly lowers CaC and implementation time.

Take a user-centric approach

In an industry that can’t afford downtime, you can’t throw a tool at the workforce and expect them to figure it out. Take a user-centric approach that can be fit into existing workflows, working alongside the end-users and solving the problem together. You can have the best product in the world, but if you don’t know your end user and it’s not easy to adopt and use, you’ll stall.

AI needs to focus on proprietary data

The industrial sector holds a wealth of untouched data, so there’s a rich opportunity for AI optimization. However, there is first a need to clean and aggregate this data to earn the trust of customers. Focus on defensibility through the use of proprietary foundational data assets — critical data unique to a market, platform, or business outcome. As the intelligence layer becomes commoditized, leveraging unique data becomes essential for maintaining a competitive edge.

The resources

If you want to learn more, here are some resources our team and founders recommend.

- McKinsey, What are Industry 4.0, the Fourth Industrial Revolution, and 4IR?: A deep dive into the concepts around Industry 4.0.

- Aditya Raghupathy’s Substack, Breaking the Bottleneck: A weekly newsletter with perspectives and updates on manufacturing news, funding, startups, and building venture businesses.

- Momenta Partners, Insights: A blog from a leading industrial impact venture firm.

- Robin Dechant, The Future of Manufacturing: An interview series with founders and commercial leaders of manufacturing technology companies.

- David Rogers, Exponential Industry: A weekly look at manufacturing and supply chain technology adoption within Industry 4.0, and covers the breakthroughs in additive manufacturing, machine learning, robotics, IoT, and the industrial metaverse.

*Note: Insight Partners has invested in Upkeep, Tulip, Keyfactor, SentinelOne, Augury, Seeq, Intenseye, Imubit, Tenable, and Armis