Enterprise and consumer clients often require more reassurance that companies are doing their due diligence for financial integrity, customer data, privacy and security in today’s fiercely competitive market. Failing to adequately address these concerns could lead to inability to acquire new customers and even the churn and loss of existing clients.

Some compliance golden standards are more important than others, while many organizations learn too late that certain customers will only work with vendors and suppliers that adhere to specific compliance measures. System and Organization Control (SOC) reporting is a common must-have compliance that many customers will require. The good news is that adopting SOC can help bolster your customers’ trust in your organization’s internal controls and procedures.

Customer-Focused CIOs and CFOs see compliance as table stakes for establishing trust and driving growth.

What is SOC?

A System and Organization Control (SOC) report is the result of an audit of a company’s internal systems and procedures. The set of guidelines and standards examined by SOC audits are set by the American Institute of Certified Public Accounting (AICPA).

SOC 1, SOC 2 and SOC 3

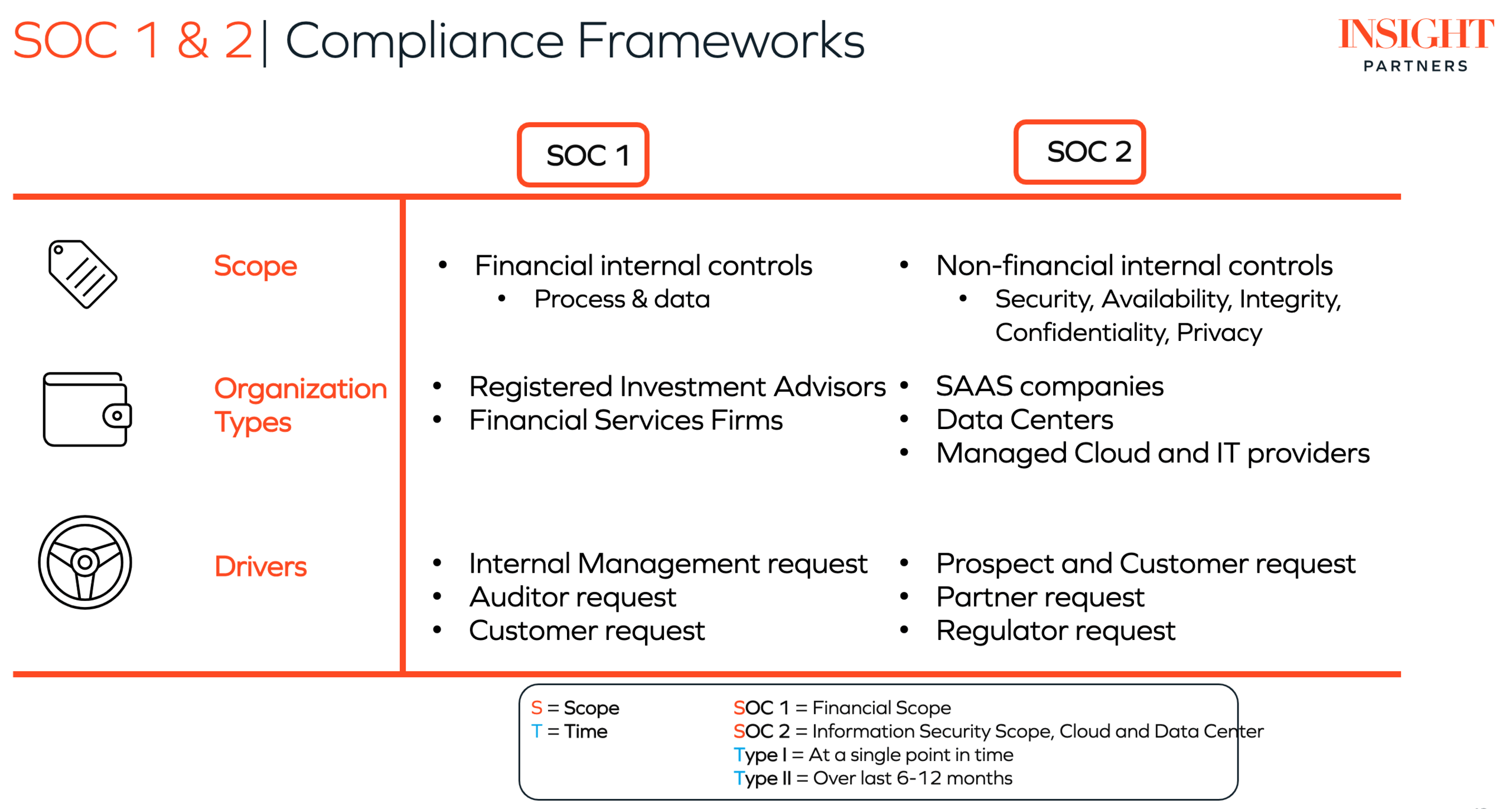

There are three SOC reports: SOC 1, SOC 2 and SOC 3:

SOC 1 mostly covers the internal financial-reporting practices of a company.

SOC 2 helps to ensure non-financial security and trust compliance, including data security, privacy, and confidentiality.

SOC 3 covers the same areas of compliance as SOC 2, but the report is less detailed, less technical, and more suitable for general use.

There are also types of SOC reports: Both SOC 1 and SOC 2 have Type I and Type II reports, which have different requirements. A good way to think about the distinction is that SOC 1 and SOC 2 refer to different scopes (what is examined), while Type I and Type II for either report refer to different time frames over which the company is evaluated. It should be noted that the three reports are not inclusive — achieving SOC 2 compliance does not mean you are automatically SOC 1 compliant. SOC 3 compliance does not automatically guarantee SOC 1 and 2 compliance.

SOC vs. SOX

SOC 1 compliance is also distinct from SOX compliance. SOX refers to the Sarbanes-Oxley Act, a federal law that requires companies to follow certain financial-record keeping and reporting practices. While both SOC 1 and SOX compliance involves auditing internal financial controls,

- SOX is a federal regulation for public companies and provides for civil and criminal liabilities if procedures are not properly followed. SOX contains a number of regulations that prevent both public and private companies from impeding federal investigations, such as in cases of fraud.

- In contrast, SOC 1 audits are voluntary and smaller in scope — they satisfy some, but not all sections of a SOX compliance audit.

SOC 1 Fundamentals

For a company to undergo and pass a SOC 1 audit, the organization must declare its procedures for the internal control of financial reporting (ICFR) to an auditor, who is usually a licensed certified public accountant (CPA). The auditor then reviews them for appropriateness when considering the services the company offers. The two different types of SOC 1 audits have different reporting periods – SOC 1 Type I only relies on declared practices and their suitability for the company’s core business at an individual point in time. It does not conduct an audit over time, nor does it verify whether the company follows its own policies.

By contrast, a SOC 1 Type II audit verifies not only that the company’s declared practices are appropriate, but that the company follows its own procedures over a period of time (usually six to 12 months). This is where the thoroughness of the audit can drive value for businesses. The additional verification that your organization consistently and thoroughly implements SOC 1 Type I-compliant policies can boost customer trust by demonstrating rigor in internal procedures. SOC 1 audits can also help build investor and customer confidence by demonstrating that your leadership has a good understanding of the financial reporting requirements and risks, and is proactively working to mitigate those risks.

Why do I need a SOC 1 audit?

Some startups do business in sectors that will never require SOC 1 controls. However, for any company that handles financial transactions, insurance or payments, SOC 1 compliance can provide customers and clients with additional reassurance that your company’s internal practices are reliable.

Consider this in the context of the growing financial technology (fintech) industry. The global fintech market is expected to be worth over $300 billion by 2025. Tech companies are also expanding into other sectors of the economy such as insurance and healthcare. Businesses in any of these categories handle massive financial transactions using cloud infrastructure and may also be subject to additional requirements around customer privacy, confidentiality and security.

Tech startups often focus on the security and privacy requirements when it comes to governance, risk and compliance (GRC), perhaps because these are the easiest to tackle using engineering solutions. But, financial reporting and lack of proper internal processes when handling financial transactions can cause multi-million dollar liabilities.

Personalized investment startup Robinhood famously had to pay a $70 million fine in 2021 for process failures leading to customer misinformation and massive outages. While this fine was not directly linked to a SOC 1 audit failure, it is indicative of the magnitude of liabilities that financial services companies can incur if they lack internal controls and procedures that are certified to meet regulatory standards.

Startups often overlook SOC 1

Unfortunately for startups, compliance failures and ICFR weaknesses are common among recently created companies. Audit statistics reveal that on average, at least 10% of annual SOX audit filings reveal “adverse attestations”: i.e. audits indicating ineffective internal controls on financial reporting. The long-term trend shows increasing numbers of first-time compliance audits failing.

To establish and reinforce process, discipline and maturity needed for a federal SOX audit, voluntary SOC 1 audits are recommended.

Compliance (or lack of it) can be a stumbling block for startups looking to gain traction in a crowded space. The penalties for failing compliance checks significantly outweigh the costs of compliance itself. Even worse, incurring high penalties for regulatory malpractice can drastically reduce customer and investor confidence in a startup. For investors particularly, failure to perform due diligence when it comes to factors like internal systems and financial reporting raises questions about whether investment capital will go towards growing the business or paying fines to regulators for preventable errors.

How Insight Partners can help you get SOC 1

Achieving SOC 1 compliance can be intimidating for startups new to the industry. Insight Partners provides a number of resources, as well as direct partnerships to help companies on their road to SOC 1 Type I and SOC 1 Type II compliance.

Insight Partners’ portfolio company FloQast offers SOC 1 Type II certification based on review of internal financial protocols by third-party auditors. Portfolio companies Diligent and OneTrust also offer SOX compliance consultations and services, allowing companies to clear federal regulatory hurdles.

Partnering with these companies to complete SOC 1 Type I or SOC 1 Type II audits can provide your business with the tools it needs to boost customer and investor confidence, maintain rigor and best practices from the ground up and avoid potential costly penalties. Ultimately, SOC 1 compliance will provide a strong foundation for your startup's compliance policies and boost your company's growth.

Transformational CIOs and CFOs ensure SOC compliance as table stakes early in the life cycle of a startup, so they can focus on contributing to the top line in addition to improving the bottom line.