A conversation with NYSE: Preparing now to ring the bell tomorrow

After a sluggish IPO market in recent years, 2025 is shaping up to be a pivotal moment for companies considering going public. Investor confidence is returning, and valuations are trending upward after the Great Reset of 2024. Yet, while the window for IPOs is opening, it will not stay open forever. Founders aiming to capitalize on this moment need to start preparing now.

The right time to go public

Managing Director Ryan Hinkle sat down with New York Stock Exchange (NYSE) Vice Chairman and Global Head of Capital Markets Michael Harris to discuss a key question for founders: When is the right time to go public? The answer is far more nuanced than simply “when the window is open.” Watch their full conversation below.

As Hinkle put it,

“The colloquial notion is there are these windows that are open and shut, and I argue that that oversimplifies it. It is true. It is accurate. Windows are open and shut, but how do they shut? Why do they shut so fast and open so slowly?”

The four paradoxes of IPO readiness

Hinkle emphasized that an IPO window is not just a matter of market conditions; it is the result of four key players aligning: management, the board, underwriters, and investors. If any one of these is misaligned, the IPO window effectively shuts.

The management dilemma

Founders face an inherent conflict: They want to wait until everything is perfect, yet they also feel the urgency to move when conditions seem favorable. Hinkle described this internal struggle:

“Management wants to wait forever, and they want to get going already. They want to just get the puck on the ice, and they want to wait forever to have everything perfect. And that is the paradox you have got to resolve.”

The reality is that no company is ever 100% ready, but public investors expect leadership to demonstrate consistent performance before making the leap.

The board’s strategic positioning

Many boards want to retain private control for as long as possible but recognize the strategic advantages of being public — public stock can be used for acquisitions, brand credibility may rise, and the company gains access to new pools of capital.

Underwriters and pricing

Underwriters aim to ensure a high valuation for the company but also must structure the offering in a way that aligns with current market sentiment.

“The board has to get alignment. The underwriters want the best possible price and the lowest possible price, and it has to fit inside the market conditions,” says Hinkle. Striking this balance determines how well investors receive an IPO.

Investor confidence

Public markets are generally not forgiving of uncertainty. Investors should believe in the company’s ability to maintain valuation stability.

“By being in common stock, all of a sudden, if things do not go well and there is a significant repricing, there is exposure,” Hinkle noted. “So the investors have to have high confidence in the durability of the valuations. You want to have the IPO for that big potential pop in future value, but you want to make sure that your downside is still protected.”

An IPO is not a short-term liquidity event — it is a long-term public commitment, and investor confidence determines whether a company thrives post-listing.

“The window shuts if any one of those four things is a no. You need four yeses. And then, and only then, is it open.”

Lessons from Smartsheet: Why IPO success is built years before the bell rings

When Hinkle first led Insight Partners’ investment in Smartsheet, the company had just $8 million in trailing revenue and burned as much cash as it was bringing in. It was far from IPO-ready. But what stood out to Hinkle was not just the product; it was how customers were using it.

“[Smartsheet wasn’t] just competing against spreadsheets…they were competing against Post-it notes, these little reminders to get things done,” says Hinkle.

Unlike consumer apps that scale overnight, Smartsheet’s growth was methodical. The company was not just retaining customers; it was expanding them. But early on, the numbers did not fully reflect that strength.

“If we just looked at retention alone, retention wasn’t that good, because a lot of people would try it for a month or two and quit. You had to look past the 90th day and say, ‘Think of it as a 90-day trial, and start on day 90, then I look at my retention all of a sudden, conventional 85%, 90% worked.”

As Smartsheet prepared for its IPO, the focus was not just on revenue milestones but also on preparation.

“Build that infrastructure as early as possible, and have every department understand their role in what they’re doing and how it relates to unit math because that unit math will ultimately drive not only growth rate but profit level.”

Standing on the NYSE balcony with the Smartsheet team was not just a celebration of going public; it was proof that the company had built something durable.

What founders must do now to IPO

Given the current landscape — where macroeconomic conditions are favorable but unpredictability still looms — founders should focus on IPO preparation rather than timing the market.

Establish predictability

Public markets generally favor stability. Typically, companies must demonstrate at least four to five consecutive quarters of consistent financial performance before even considering an IPO. That consistency should extend beyond revenue to key metrics such as customer retention, expansion rates, and operating efficiency.

“You need four to five quarters before you start dipping that toe into the water with no bad stuff happening,” says Hinkle. “But, because the capital markets have gotten so deep in the private markets, access to capital is not the catalyst to go public.”

Solidify leadership and governance

An IPO is not just a milestone — it is a permanent shift in how a company operates. Leadership teams must be stable well before going public.

“You want your team relatively stable for at least a year, and by team [I mean], your head of revenue, your head of finance, your CEO, depending on how heavy the tech burden, probably your head of technology,” says Hinkle.

Beyond executive stability, boards should be optimized for the public markets, balancing the founder’s vision with experienced public company governance.

Prepare for public scrutiny

Private companies have the luxury of flexible reporting; public companies do not. Every metric disclosed at IPO becomes a permanent benchmark. Founders must refine their reporting structure to ensure they can consistently meet — or ideally, exceed — market expectations on a quarterly basis.

“Anything you share, you are making a determination to share forever,” says Hinkle. “And this is a huge breach between the world of private investing and the world of public investing.”

Assess the strategic motive

An IPO should never be pursued simply because the market is receptive. The best companies go public with a clear rationale — whether it be branding, talent acquisition, access to capital, or M&A strategy.

“I believe that ‘Why are you going public?’ needs an answer — besides, ‘because it is there.’ This is not Mount Everest,” says Hinkle.

Build a strong investor relations strategy

Investor relations (IR) is often an afterthought for private companies, but it becomes critical the moment a company goes public. IR teams must build relationships with analysts, institutional investors, and retail shareholders to ensure that the company’s story is well understood and effectively communicated.

Without strong IR, companies risk misalignment between internal expectations and market perception, which can lead to stock volatility and difficulty raising capital post-IPO.

Now is the time to prepare, not rush

Many indicators suggest that the IPO market in 2025 will be significantly stronger than the previous two years. However, stability — not just opportunity — can determine whether a company should take the leap. The companies that succeed in going public are often those that have prepared proactively rather than those that rush to be reactive.

Hinkle remarks on his outlook: “I’m rooting for extended ‘normal’ [in the markets]…by having predictability and normal persist…it is good and necessary for more tech IPOs, it is necessary for good IPOs, and those things beget success. A couple more successful IPOs that have prices that stick will increase multiples and it just starts this flywheel effect. We can get that flywheel spinning in a major way, and it has been stuck since Q1 2022.”

Founders who prepare today will be the ones ringing the bell tomorrow.

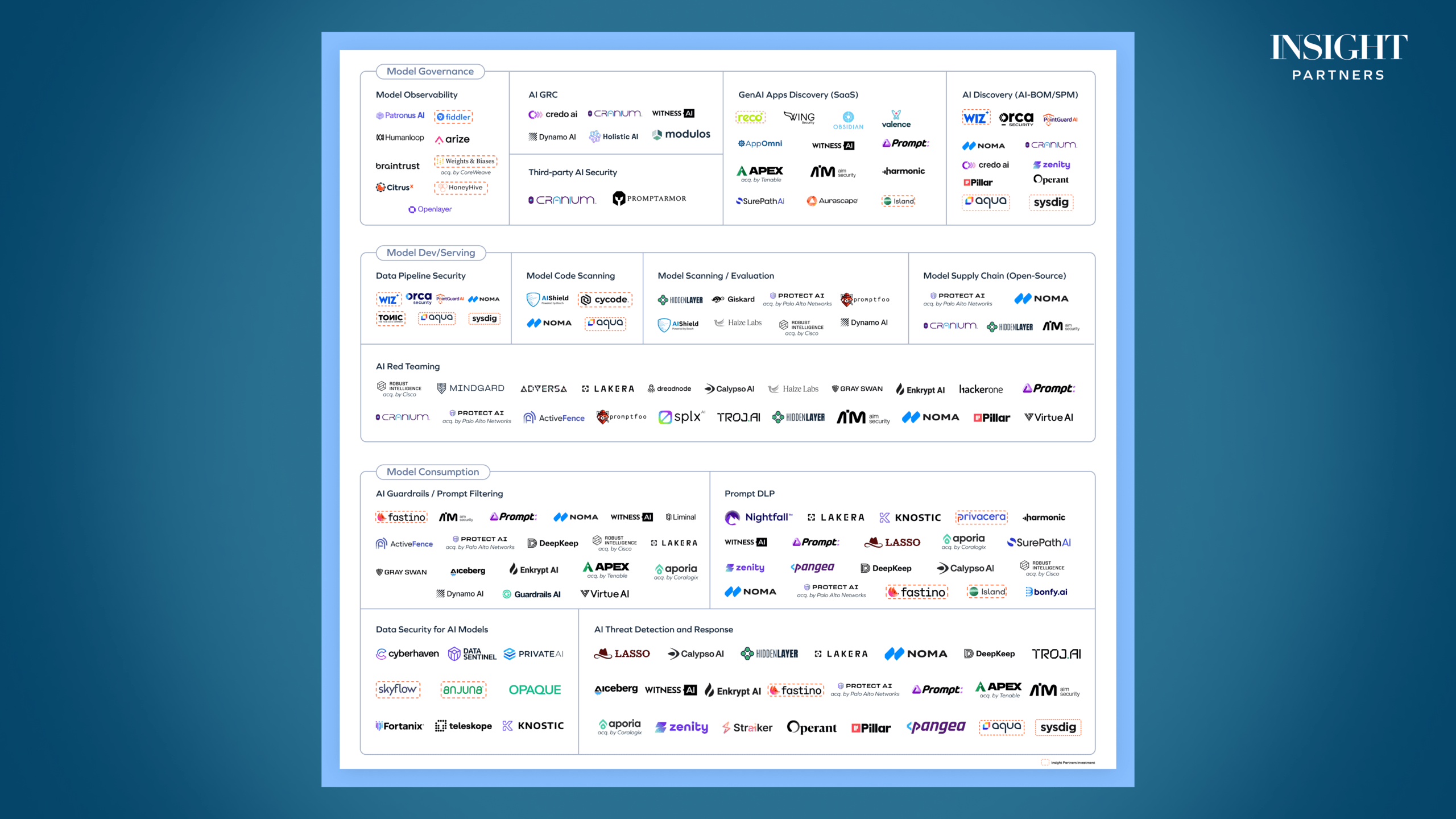

*Note: Graphics in this article are for illustrative purposes only.