Choosing your next market: A data-driven approach to global expansion

The following is an excerpt from the whitepaper Building Locally, Scaling Globally: A SaaS founders’ 7-step guide for global expansion

Expanding into a new market is one of the most exciting—and challenging—milestones for a SaaS company. But with so many potential geographies to consider, how do you choose the right one? The key lies in data-driven decision-making. From analyzing inbound demand to assessing market fit and competitive landscapes, founders must take a strategic approach to global expansion

To choose your new market, ask yourself where you’re already getting inbound leads from, which geographies are similar to your home market, and closely evaluate the nuances of localization.

Evaluate demand and market fit

Selecting which market to expand into first can feel as daunting as it can exciting. But in reality, there are a limited set of geographies to consider. Start by identifying where your product is already gaining traction. Inbound leads, website traffic, and customer feedback often reveal markets with strong interest.

“If you get a lot of inbound leads from countries where you don’t yet operate, look to see if there are any patterns in where they’re coming from—it may make sense to start there as you have buyers waiting for you to serve their market,” says Rebecca Liu-Doyle, managing director at Insight Partners.

Another indicator of potential interest lies within your existing customer base. They already use your product and may have a need for it in other geographies as well.

“If your customers have a particularly strong presence in another country, that could be a smart market to enter,” says Liu-Doyle. “You also have the advantage of being able to talk to your customers and establish demand before you invest in the expansion.”

Competition can also signal opportunity. While counterintuitive, the presence of competitors often validates demand and shows that customers are already educated about your product category.

“Competitors are a form of market validation. If you’re entering a market without any competition, you need to find out if it’s because potential customers aren’t aware of your kind of product, or there simply isn’t enough demand,” says Richard Sgro, senior vice president at Insight Partners.

“Competitors are a form of market validation. If you’re entering a market without any competition, you need to find out if it’s because potential customers aren’t aware of your kind of product, or there simply isn’t enough demand.”

Consider adjacent and regional opportunities

Neighboring or culturally similar markets are often logical first steps in expansion. These regions typically require less adaptation and allow your team to test and refine go-to-market strategies. However, even small differences in language, culture, or regulations can impact adoption, so localization is key.

“It’s the factor that founders under appreciate the most,” says Sgro. “[US Founders] think everything can be in English in every market, but that approach starts to fall apart very quickly.”

“Even when two markets look identical, there will be nuances that can make them very different,” adds Travis Kassay, operating partner at Insight Partners.

“Even when two markets look identical, there will be nuances that can make them very different.”

Staffbase, for example, started its international growth by expanding into other German-speaking countries like Austria and Switzerland. They found success in selecting smaller, similar markets before taking on larger, more complex markets.

When evaluating a region, don’t stop at the country level—specific cities or areas often play an outsized role in different industries. Look for hubs that align with your target audience, industry presence, or cost considerations. For example, in the US, Boston is the place to go if your SaaS is in the healthcare tech vertical. Choose your landing spot wisely to set yourself up for optimal networking with those in your industry.

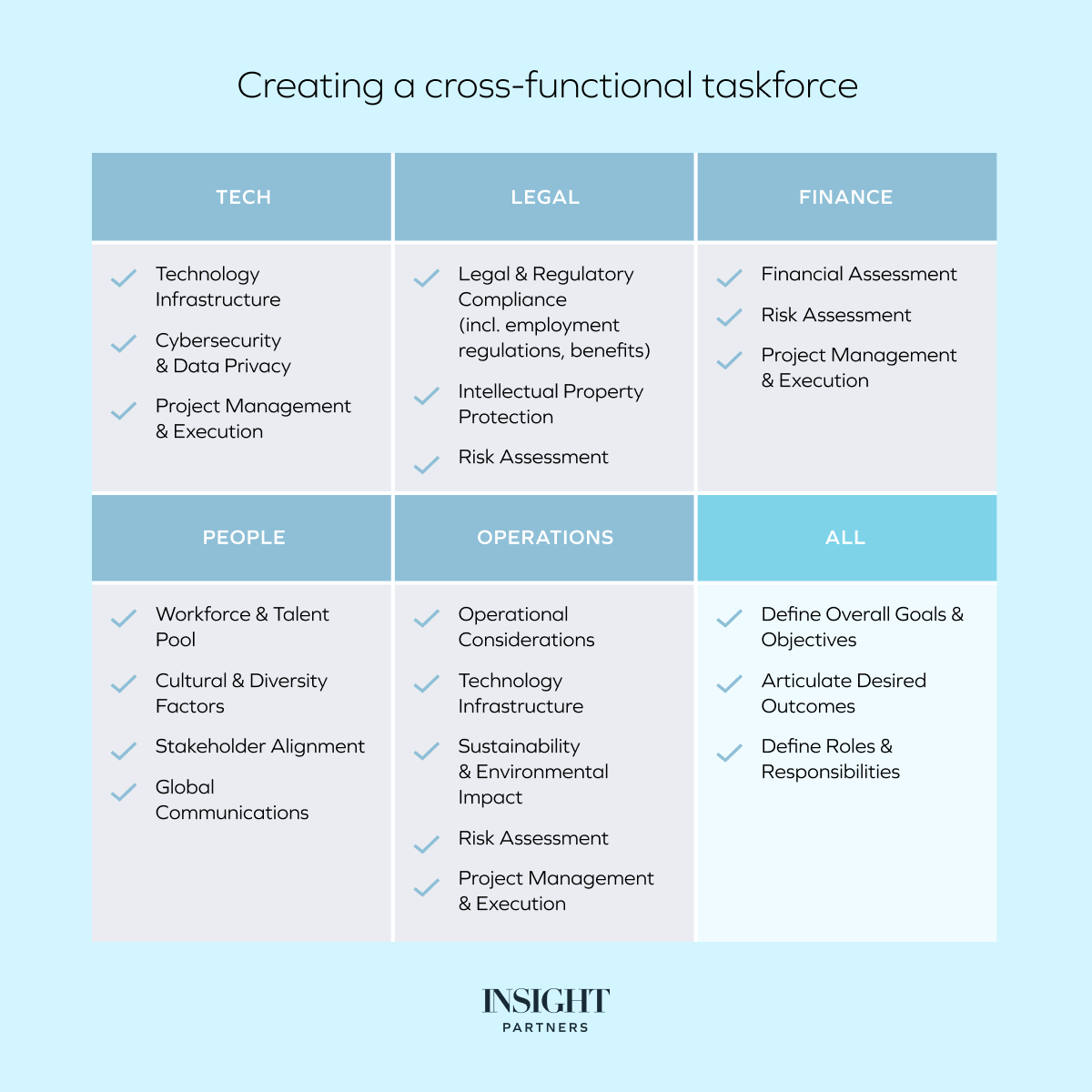

Tapping into the team

To decide which market to expand into, establish a cross-functional project team to work together and make an informed decision. The team should include representatives from key departments such as tech, legal, finance, people, operations and executive leadership, and must consider the perspectives and expertise of each department.

Use data to make your decisions

Many companies stumble by selecting markets based on intuition rather than data. For example, expanding into a city with a high cost of living can lead to resource drain early on.

“This is particularly common for companies expanding into the US. Founders often land in New York or San Francisco, but both are very expensive and competitive, which can make it difficult to hire top talent and may slow you down tremendously,” says Liu-Doyle. “Companies should also consider less saturated cities like Atlanta, Boston, or Raleigh.”

Another data point to consider is the market size and opportunity.

“Work out what your TAM is and what portion is obtainable within the market you’re assessing,” says Meg Fitzgerald, senior vice president at Insight Partners.

“Work out what your TAM is and what portion is obtainable within the market you’re assessing.”

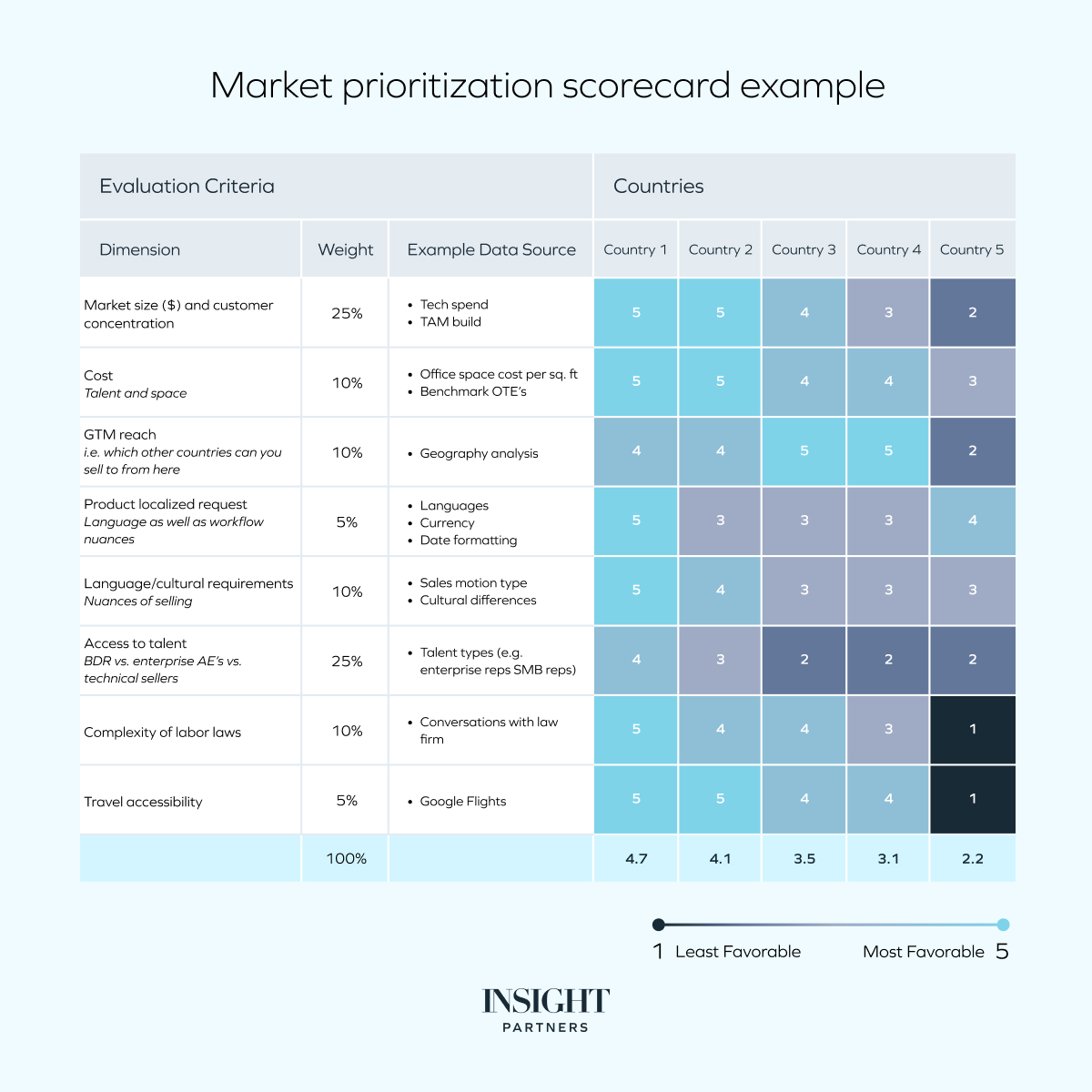

We recommend using a scorecard to help you to evaluate your target markets against different criteria. A scorecard should include factors like market size, customer demand, competitive landscape, and ease of doing business. Prioritize markets where you can win—not just those that appear exciting or high-profile.

Evaluating your next market

To determine which market to expand into next, consider using a scorecard to objectively evaluate a range of geographies.

Check out our related guides

- Building locally, scaling globally: How India will become the world’s next tech powerhouse

- Building locally, scaling globally: Navigating international expansion for European founders