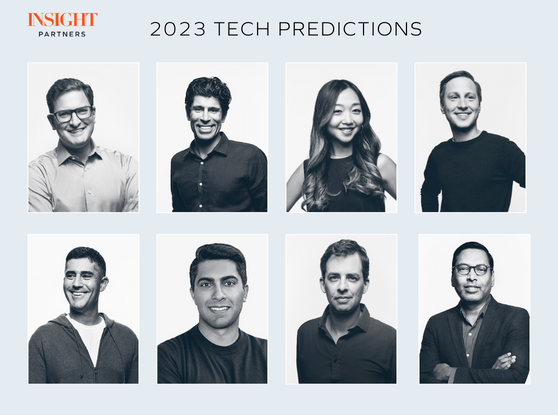

8 Tech Investors Share Predictions for 2023

2022 was a busy year for the team at Insight. As hype started to build around the use of AI in our everyday lives, Insight held its first ScaleUp:AI conference, featuring top industry speakers and hosting over 1,700 attendees. The firm also grew the Onsite team — Insight’s dedicated ScaleUp engine of Sales, CS, Product, Marketing, and Talent experts — to over 120 operators to better support portfolio companies, help them focus on metrics that move the needle, and prepare them for whatever comes next.

As we wind down the year, eight of Insight’s Managing Directors share some thoughts about what’s top of mind for tech investors going into 2023.

Ryan Hinkle, AJ Malhotra, Rebecca Liu-Doyle, Thomas Krane

Michael Yamnitsky, Nikhil Sachdev, Lonne Jaffe, George Mathew

We’re going to hear a lot more about AI.

If 2022 was the year of crypto, 2023 will be the year of AI truly breaking into the general population’s awareness.

The shift from analytical AI to generative AI

Lonne Jaffe: “Many had been operating under the assumption that manual labor and simpler knowledge work would be most disrupted by AI and automation, but with large foundation models like GPT-3 and DALL-E, we’re seeing AI systems make enormous progress in highly creative tasks like design, programming, music, and creative writing. This will likely continue in 2023 with the release of systems like GPT-4. At the moment, the reliability of these models is still a major challenge — they often hallucinate answers that are false but still ‘speak’ confidently. This kind of unreliability could be problematic for a lot of use cases, like customer service, education, and healthcare. If you don’t already know the answer, it can be hard to tell whether some AI-generated responses are correct.”

Nikhil Sachdev: “We’re moving from analytical AI (analyzing/parsing data and identifying trends and patterns) to generative AI (creating new content or interactions based on patterns). Applications we’re seeing now are benefiting from powerful (often open source) large language models, cheaper computing costs, and established MLOps platforms. These AI applications are starting to overtake human functions and have the potential to augment and disrupt existing entrenched software apps.”

George Mathew: “More of us should be talking about explainability and bias detection as more large language models (LLMs) get to scale and production. We should all be preparing for what opportunities will emerge with a multi-trillion parameter large language model like GPT-4 being released.”

Lonne Jaffe: “It will be very interesting to watch where the value will accrue and where economic moats will be the deepest. Some believe that the economic moats will accrue to the companies building the large foundation models because they require so much time, skill, and infrastructure spend. Others think that the moats will be with the companies fine-tuning the models for specific use cases because of the feedback data demand-side economies of scale. Still others believe that the value will be in the non-AI software that allows the models to integrate with real-world systems. There may even be a layer of value in between the foundation model creation and fine-tuning, requiring a new set of MLOps tools and skills that focus the foundation model for a specific domain, but in a way that is more involved in modifying the internals of the foundation model than needed during the fine-tuning process.”

Moving from AI in infrastructure to AI in applied real-life situations

Lonne Jaffe: “One area where we’re likely going to see continued huge progress in 2023 is in applied computer vision AI in healthcare. The tech is already approaching human ability in domains as varied as polyp detection in colonoscopies, diagnosing gum disease in dentistry, breast cancer screening in a mammogram, etc. This can improve diagnostic accuracy, save physician time, surface candidates who would benefit from clinical trials, and even reshape how the industry works.”

The metrics investors care about in 2023 will shift to retention and efficiency.

“More nailing it, less scaling it.”

Ryan Hinkle, Managing Director: “2023 is about more nailing it, less scaling it. 2023 should be a year where it’s efficiency first, additional costs second. It is really difficult to focus on efficiency when you are adding costs. That is the fundamental pendulum shift: it has abruptly shifted from ‘if you believe it, it will come’ to ‘if you can’t see it, it doesn’t exist.’”

Metrics that matter

Nikhil Sachdev: “Customer NPS is always important, even more so in this environment. (Are you nice to have? Or, I can’t live without you?) NPS flows through all the relevant financial metrics in a business. The more customer value/love you generate, the better your logo growth, pricing power, retention, and efficiency. And goes without saying in this market, it’s no longer growth at all costs. Companies and investors are focused on durable, efficient growth.”

George Mathew: “Gross retention — more than ever, you have to be able to retain customers to stabilize your 2023 growth plans.”

Thomas Krane: “Path to breakeven based on current balance sheet, cash burn as a multiple of net-new ARR.”

AJ Malhotra: “It’s all about how you’re investing to drive efficient growth. My key metrics are about the same: previously, it was all about net-new ARR, and now gross profit matters more. Your true gross (and net) retention becomes very, very important as well — this separates strong companies from weak ones. Cash burn also becomes imperative in this environment.”

Rebecca Liu-Doyle: “In this environment, two things investors are watching especially closely are gross margin and gross retention, both of which are prime leading indicators for steady-state free cash flow potential. In steady state, will this be a 15%+, 25%+, or 50%+ FCF business?”

DevOps will prioritize simplicity.

Michael Yamnitsky comments on the developer perspective: “The great vibe shift of 2023 is a return to simplicity! Back in 2017, it was cool to tinker with the nuts and bolts of Kubernetes, but as of 2022, we’ve reached peak complexity and specialization in cloud infrastructure, and the pendulum is swinging back. Developers want to simplify their stack and ship code faster. To this tune, we’ll see a resurgence of PaaS and other developer-friendly services that eliminate the toil while retaining all the benefits of 10+ years of advances in cloud technology.”

Thomas Krane, Managing Director: “In DevOps, cost pressure will put new pressure on public cloud workload adoptions and reinforce the need to have interoperability between on-premises IT and cloud services. This creates opportunities for new vendors in the space.”

Rust will be all the rage

Additionally, Michael adds: “Rust is all the rage and demand for rust programmers is growing. The performative nature of this programming language makes it a fit for backend-heavy development, particularly in the infrastructure and developer tooling space where performance can be a key differentiator.”

The overall economic environment will be uncertain for a while, but it’s not all bad news.

Ryan Hinkle: “None of us are used to inflation. Inflation hasn’t been a consideration for literally 30 years. Because of inflation, if you aren’t growing 8%, you are shrinking on a real basis. We enter 2023 with a great deal of known issues — inflation being front and center — but no real ability to forecast what comes next. In 2023, we will need to re-evaluate on a quarterly basis or even more frequently, as a year will feel like an eternity. Years make sense as forecast building blocks when things are well-behaved. These are not well-behaved times.”

Nikhil Sachdev: “Market sentiment is as negative as it has been since the Great Recession. We are seeing a combo of inflation, rising rates, cratering multiples, geopolitical turmoil, and de-globalization, which is impacting our supply chains. On top of that, the demand curve is being whipsawed – first as we lap a period of strong pull forward in digital growth driven by the pandemic period, and now budgets and spend tightening. It’s time to go back to basics — focusing on durable growth and building/scaling efficiently are the fundamentals that will enable companies to succeed regardless of the macro. Just remember that things are never as bad as they seem at the bottom and never as good as they seem at the top.”

Thomas Krane: “Companies that largely sell into tech companies with products linked to headcount will see a significant medium-term downdraft in revenue, but there will be a strong recovery on the other side for those that survive.”

Survival of the strongest will drive consolidation

Nikhil Sachdev: “So much of the bad news is out and now baked in the cake that on balance I think equity markets will be more constructive over the next year. I think we’ll see more private tech dealmaking. Growth-stage companies will still need to raise money, maybe at different multiples than before. We are also going to see much more consolidation as companies that can’t or don’t want to continue down the standalone path look to partner with strategics.”

AJ Malhotra: “We’ll see consolidation — lots of companies have raised lots of money, with unsustainable burn rates, cost structures that may not be efficient, and that means some will not be able to raise follow-on rounds and will need to sell. The velocity of fundraising that happened in the tailwinds of Covid from 2021-2022 was a unique moment in time.”

Ryan Hinkle: “Whatever this recession will be, it will really test what is ‘needs to have’ vs. ‘nice to have’ and inform what gross and net retention looks like. We have not had a meaningful downturn since SaaS emerged as a dominant trend in digital transformation.”

There are opportunities in uncertainty

Lonne Jaffe offers several examples of how tech, and AI specifically, could help to alleviate inflationary pressure: “The go-to reaction to inflation is to have Federal Reserve Bank raise interest rates and to slow the economy and raise unemployment. But this comes at a huge cost. Despite the anxiety around robots and automation taking jobs, there can be an opportunity for tech to help alleviate inflationary pressure by increasing efficiencies and making us all more productive. In a similar way as collaboration software helped the economy cope with isolation from the pandemic, this kind of AI-powered efficiency improvement, in a way, could become the unsung hero of this inflationary crisis period.”

George Mathew: “Backoffice sectors like supply chain, procurement, and business process outsourcing all have fundamental opportunities to be transformed by generative AI.”

Thomas Krane: “The cost of cloud services will create opportunities to preserve and even expand on-premises IT.”

Michael Yamnitsky: “One of the positives of continued economic uncertainty going into the new year: the spotlight shifts away from the hype-chasers and storytellers and towards the humble entrepreneur who has been quietly owning their craft.”

Rebecca Liu-Doyle: “Certain categories — like beauty in consumer and automation in enterprise SaaS — have counter-cyclical tailwinds, and this may be their moment to shine.”

AJ Malhotra: “New company formation will increase because of layoffs, and lots of talented folks will have new time on their hands to build something new.”

Hiring might get easier.

George Mathew: “There will be a much more available labor market as hundreds of thousands of tech workers are being laid off at the ‘Big Tech’ firms.”

AJ Malhotra agrees: “Hiring is a big opportunity right now! A lot of good people are in the job market because of layoffs. Hiring may become easier given the talent out there. We have dueling realities — giant tech companies are doing layoffs and hiring freezes, but unemployment is low. We’re still seeing hiring in many industries.”

There’s still a lot to be excited about in tech.

Nikhil Sachdev: “While I acknowledge we are in a peak hype cycle for AI, I think the secular trend is real and feels like we are on the verge of an explosion here. AI will impact horizontal and vertical segments within software.”

Michael Yamnitsky: “I’m excited about WebAssembly. It has the potential to bring unparalleled levels of efficiency and security to computing and transform the way developers organize and collaborate around code. But most importantly, it’s portable — making it a unique fit for the next wave of distributed applications.”

Thomas Krane: “Threat intel will finally get recognition as a critical baseline/foundational priority for a strong cybersecurity stack.”

AJ Malhotra: “It’s easy to be a pessimist but there are a lot of good things happening right now: hybrid work environments are better overall and have provided more flexibility to people, there’s low unemployment. There’s tons of opportunity to do things more productively and more efficiently. Tech dealing with carbon emissions and clean energy transitions, enterprise software selling into financial services, software for the build environment, and tech dedicated to improving healthcare delivery are all exciting areas right now.”

This post was compiled and edited for conciseness and clarity by Jen Jordan.

—

Disclaimer: All securities investments risk the loss of capital. Certain statements made throughout this post that are not historical facts may contain forward-looking statements. Any such forward-looking statements are based on assumptions that Insight believes to be reasonable, but are subject to a wide range of risks and uncertainties and, therefore, there can be no assurance that actual results may not differ from those expressed or implied by such forward-looking statements. Trends are not guaranteed to continue.