This is the second post of Insight’s series on Post-Merger Integration. See our first post here.

The aftermath of an M&A transaction is dual-faceted. On the one hand, it can present an exhilarating time of company growth as a result of access to new geographies, customers, or critical capabilities; perhaps a chance to make personal exits for hard-won equity. On the other hand, M&A creates pressure to realize the economic rationale of the deal by leading the company through a post-merger integration (PMI) plan. Where should the executive team start? What’s most important, and what’s the timeline for completion? PMI involves an overwhelming number of activities that require coordination and execution.

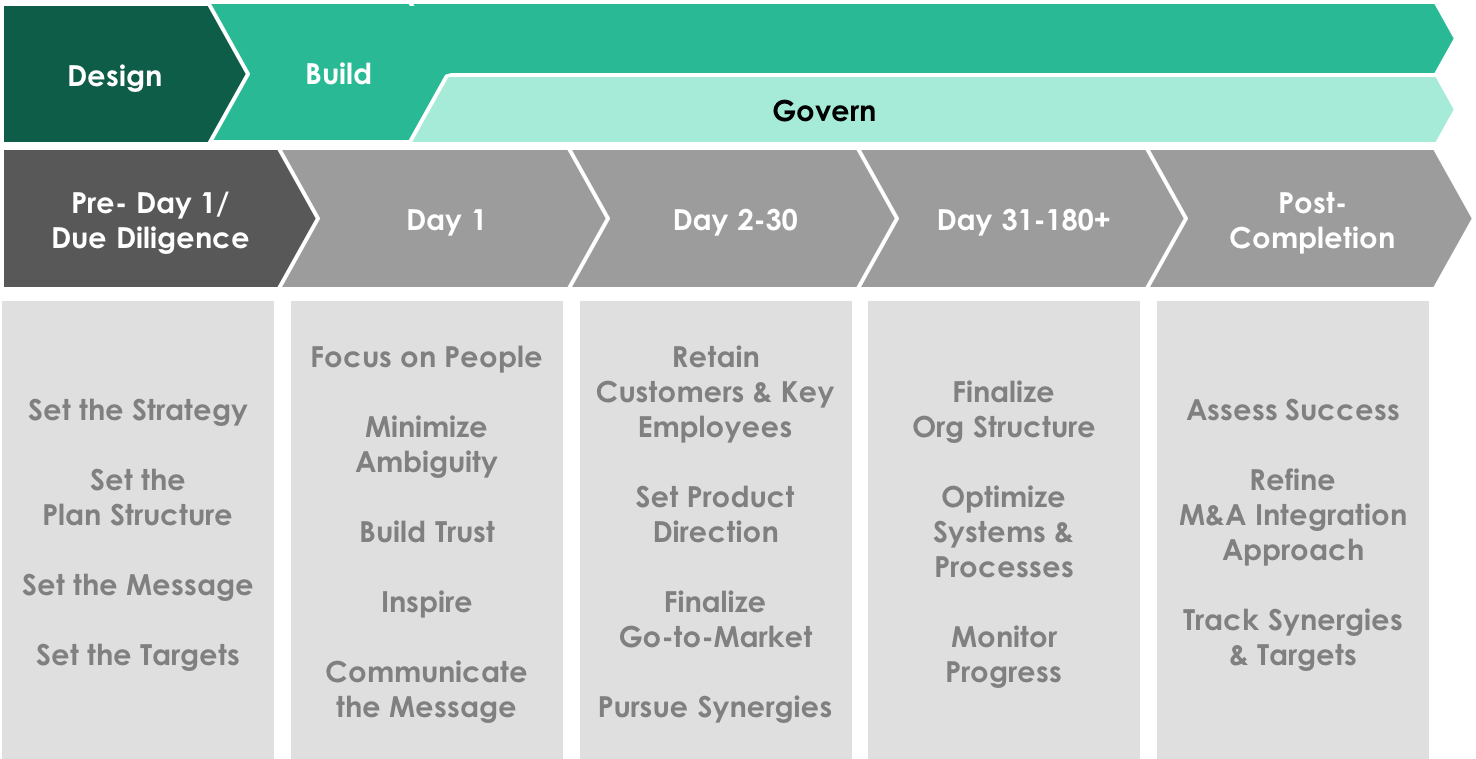

With this blog, Insight Onsite cuts through the PMI madness by providing a roadmap that enables executives to focus on the most critical priorities at every stage of integration. By focusing energy effectively, executives can elevate the positive facet of M&A while minimizing the second facet—namely, integration difficulty.

Guiding Principles at Every Phase:

Interpreting the “Guiding Principles by Phase of PMI” Roadmap

The PMI process can be dissected into three waves of activity: Design, Build, and Govern.

- Design – define the targets and strategic goals that will drive your PMI, and identify a leader to own the integration process. The Design wave typically occurs before the deal closes, in parallel with due diligence.

- Build – develop a full action plan based on the goals and targets developed during Design, and roll out the plan to the organization, assigning owners to all actions. This occurs immediately post-close.

- Govern – execute the plan, track progress to targets, and adjust actions as required to ensure integration success. This wave is iterative and lasts until PMI is completed.

Within the three PMI waves of activity, there are five distinct phases that occur over the course of an integration. Below, we lay out the Guiding Principles that every executive team must focus on during each phase to successfully execute a PMI.

Pre-Day 1 / Due Diligence

Focus on strategy and goals.

This first phase of PMI can—and should—start well before the announcement date. Even at term sheet, management teams must begin to specify what their goals are for the acquisition and explicitly define the company strategy post-acquisition. Every single one of the portfolio company executives that Onsite interviewed for this blog post said that this phase will make or break the success of an integration.

Setting strategy and goals includes defining: 1) the thesis of the transaction and go-to-market plan to achieve a strong ROI on the purchase, 2) the organizational structure required to achieve that ROI, 3) the narrative to tell employees, customers, partners and the general public, and 4) the explicit and measureable targets for the integration.

During this phase, you should also identify the team that will own the integration and hold the company accountable to executing against stated targets.

Day 1

Focus on people.

Announcement day for an acquisition is critical. M&A creates uncertainty in every employee. Do they have a job? Will that job have the same responsibilities? Will their pay and benefits stay the same? Day 1 is therefore about setting the tone and caring for your people. Your goal as an executive should be to establish credibility and trust, and to inspire employees to want to be part of the new vision for their joint company.

This requires being honest and transparent. Deliver the hard messages as soon as you have made the decision. Delaying delivery will lead people to assume the worst. If you have not made a decision, be honest about this, and give employees visibility into the timeline and criteria to make the decision.

Sweat the small stuff on Day 1 to make employees feel secure. Simple gestures like new emails and business cards, explicit seat assignments, and printed benefits packages will go a long way towards building a strong relationship.

Day 2-30

Focus on product, go-to-market and cost synergies.

Day 2-30 is typically the most complex. You should prioritize any function that impacts the customer experience – Product and all go-to-market functions like Sales, Marketing, Business Development and Support. Customers will worry about the product quality suffering due to integration distractions or a pre-conceived notion that “Product X” will be discontinued as a result of the new joint entity. Ensure that your product continues to perform well and that customers understand changes to your product roadmap. Assure customers that you will take care of them.

Go-to-market strategy and processes must be ironed out in the first 30 days. Your company’s go-to-market teams touch the customer base regularly and will be the first to answer any customer questions. The teams need to be given the information to be successful in front of customers: the integration narrative, product roadmap timelines (to the extent they are available), pricing, cross-sell strategy, presentation tools etc. – whatever they need to reassure existing customers during this phase. In parallel, begin to define the integrated Sales & Marketing structure and the path to get there – including who sells which products, when, and what their incentives are.

Day 2-30 also is where cost synergies begin to gain traction or not. In almost every acquisition there is some level of optimization baked into deal thesis. Cost take-out actions need to be swift and clean – any delay will cause uncertainty amongst all parts of the business or overreliance on capabilities that are going to be cut. These decisions are the ones that, left unmanaged, cause employee retention issues.

Remember: as you execute the activities of day 2-30, your company does not exist without its employees. Continue to ensure that key talent is retained in this phase.

Day 31-180+

Focus on putting the finishing touches on your new business.

Finalize the organizational structure down to every person in the company (assuming that this was not completed in due diligence).

After Product and go-to-market, move your attention to all the other parts of the business—systems and back-office processes. M&A can be a useful opportunity to introduce fully revamped solutions to your business, so look for areas where neither entity has an optimal solution and optimize.

Lastly – monitoring is absolutely critical to ensure that all targets are being met. The team leading the PMI should be visiting the targets set pre-Day 1 on a weekly basis and checking that all required data is being collected. If targets are not being met, raise the issues to your steering committee and course correct as needed.

Post-completion Review

Focus on improvements to your M&A processes.

Was your acquisition a success? Was the strategy or the integration the reason for the success or failure? Where could we have done better during integration?

All of these questions will be top of mind for your board members. Get out ahead of their requests by performing a post-mortem on your integration. Look at all metrics over the lifetime of the integration to understand the turning points. Also, interview employees at each level to understand how to improve the process during your next PMI.

Conclusion

If leveraged appropriately, Insight Onsite’s “Guiding Principles by Phase of PMI” can alleviate some of the chaos that comes with each wave of the integration process—design, build, and govern. Take these guiding principles into account as your team enters the Design wave, as they create functional workplans during Build, and as they measure success during Govern.

The objective of this visual roadmap is to highlight the essentials, not to narrow the scope of what must be planned and executed. A prioritization framework is no substitute for a well thought-out, granular checklist. In contrast, when you scroll through a spreadsheet with countless rows of tasks and you’re mired in the sheer madness of PMI, use this as a quick reminder of what matters most.

Please continue to join us for more PMI posts in next month’s Insight newsletter.