Planning for 2017: Making Your Customer Success List & Checking it Twice

Tradition of Annual Planning

December has arrived and with it comes the hustle and bustle of year-end. Across Insight’s portfolio, our management teams are sprinting to cross the finish line with strong momentum, all while celebrating the successes and reflecting on the lessons from the last year and setting ambitious targets for 2017.

As a Customer Success Leader, you are likely finalizing your budget, refreshing KPIs and curating a “wish list” to share with the Senior Executive Team and the Board. To build your case you need a perspective on industry best-in-class.

Defining “Good” for Customer Success

In the world of Customer Success, the lines between “good and bad” are not always clear-cut. At Insight Venture Partners, we use 4 key metrics to quickly diagnose the health of the Customer Success organization and understand outcomes, investment efficiency, and coverage.

4 Golden KPIs:

- Gross revenue churn (excluding upsells)1

- Customer retention cost (CRC)2

- Annual Recurring Revenue (ARR) per CSM

- Accounts per CSM

Gross revenue churn measures overall performance by capturing what percent of existing revenue you lost in the last year. Keep in mind that gross revenue churn is a lagging indicator.

CRC measures the level of investment needed to achieve results. CRC helps CS leaders check whether they are spending efficiently in order to achieve customer success results.

Finally, coverage ratios - ARR and number of accounts per CSM - are a baseline for team productivity helping to answer questions including do you have enough CSMs to serve the customer base? Do your CSMs have too few, too many or a manageable number of accounts?

How Does Your Business Stack Up?

Are you curious how your team and 2017 plan stack up against the four metrics?

Working with companies across our portfolio and talking with entrepreneurs, Insight Onsite believes the customer motion varies by contract size.

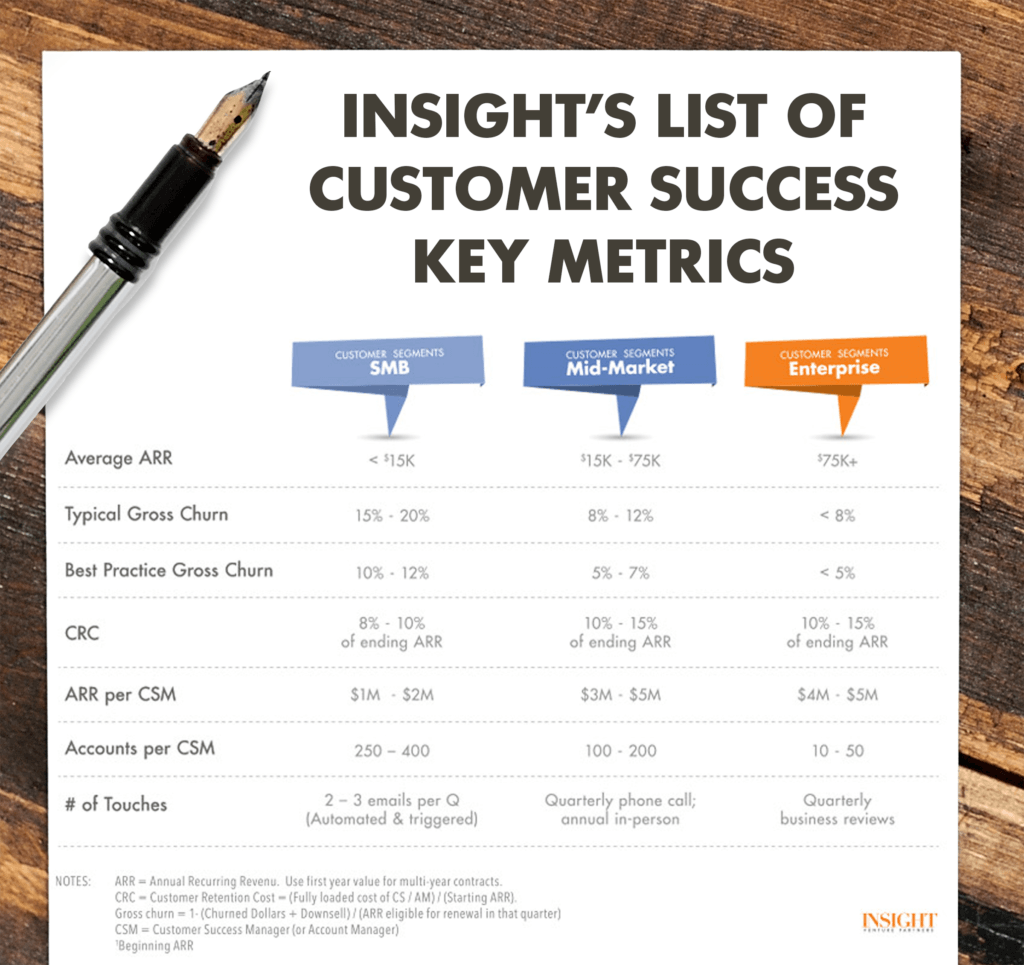

To start, first segment your company's customers by annual recurring revenue (ARR). Small to medium-sized customers typically generate less than $15,000 in ARR, mid-market customers generate $15,000 to $75,000 per year, and enterprise customers generate over $75,000 per year.

SMB Contracts

Companies targeting the SMB customer segment can expect to lose anywhere from 10 to 20 percent of their revenue, and spend 8 to 10 percent of their total ARR to retain the remaining 80 to 90 percent of revenue.

Companies targeting small to medium-sized customers ideally offer self-service tools and a uniform experience, so they're able to scale the business to thousands of customers. At Insight Venture Partners, we like to see the average account manager in this segment size handling 250 to 400 accounts each or a book of business between $1 million to $2 million in ARR.

The low-touch, high-impact model of customer retention for this segment size typically means two to three emails per quarter, either automated or triggered by specific business events.

Mid-market Contracts

For companies that target mid-market customers, we typically see a slightly higher-touch model with a mix of self-service tools and interaction points with account managers. Companies targeting this segment can expect to lose 5 to 12 percent of their revenue each year, and spend 10 to 15 percent of their ARR to retain the remaining 88 to 95 percent of revenue.

The higher touch model means fewer accounts per account manager. We typically like to see account managers who work with mid-market customers to handle 100 to 200 accounts each, generating $3 million to $5 million in ARR. Account managers here might call each customer once per quarter, and hold an in-person meeting once a year.

Strategic, Enterprise Customers

Companies that target large enterprise customers are typically engaged in very high touch models. The best companies here lose less than 5 percent of their revenue each year, and spend 10 to 15 percent of their ARR to keep that customer churn rate low.

Account managers targeting large customers might work on 10 to 50 accounts each, and generate $4 million to $5 million in ARR for their company. Account managers working with enterprise customers usually hold quarterly business reviews to maintain an intimate customer relationship and keep retention rates high.

Checking Your List

As you “check your list twice” reference Insight’s List of Customer Success Key Metrics for a fresh perspective. Based on your mix of customers, ask yourself these 3 questions:

- Investment Level: Is customer success appropriately funded to meet our objectives? How does our current and projected CRC compare to benchmark?

- Coverage: Do we have enough resource to adequate cover existing customer accounts? (Don’t forget to include anticipated new logo additions!) Can we use technology solutions to increase team productivity?

- Retention KPI: Does your team have a realistic gross retention target?

Notes: 1Gross revenue churn = 1- (Churned Dollars + Downsell) / (ARR eligible for renewal in that quarter) 2CRC = Customer Retention Cost = (Fully loaded cost of CS / AM) / (Starting ARR). CSM = Customer Success Manager (or Account Manager)